WhatsApp has been thought to be a non-US platform and naturally thought to be due to the lower penetration of Android vs. other markets. Well, Meta seems set on saying otherwise:

“Well, that seems to be changing, with the head of Meta announcing WhatsApp has reached 100 million monthly active users across the United States — with about 10 million in Texas alone. WhatsApp has more than two billion users worldwide.”

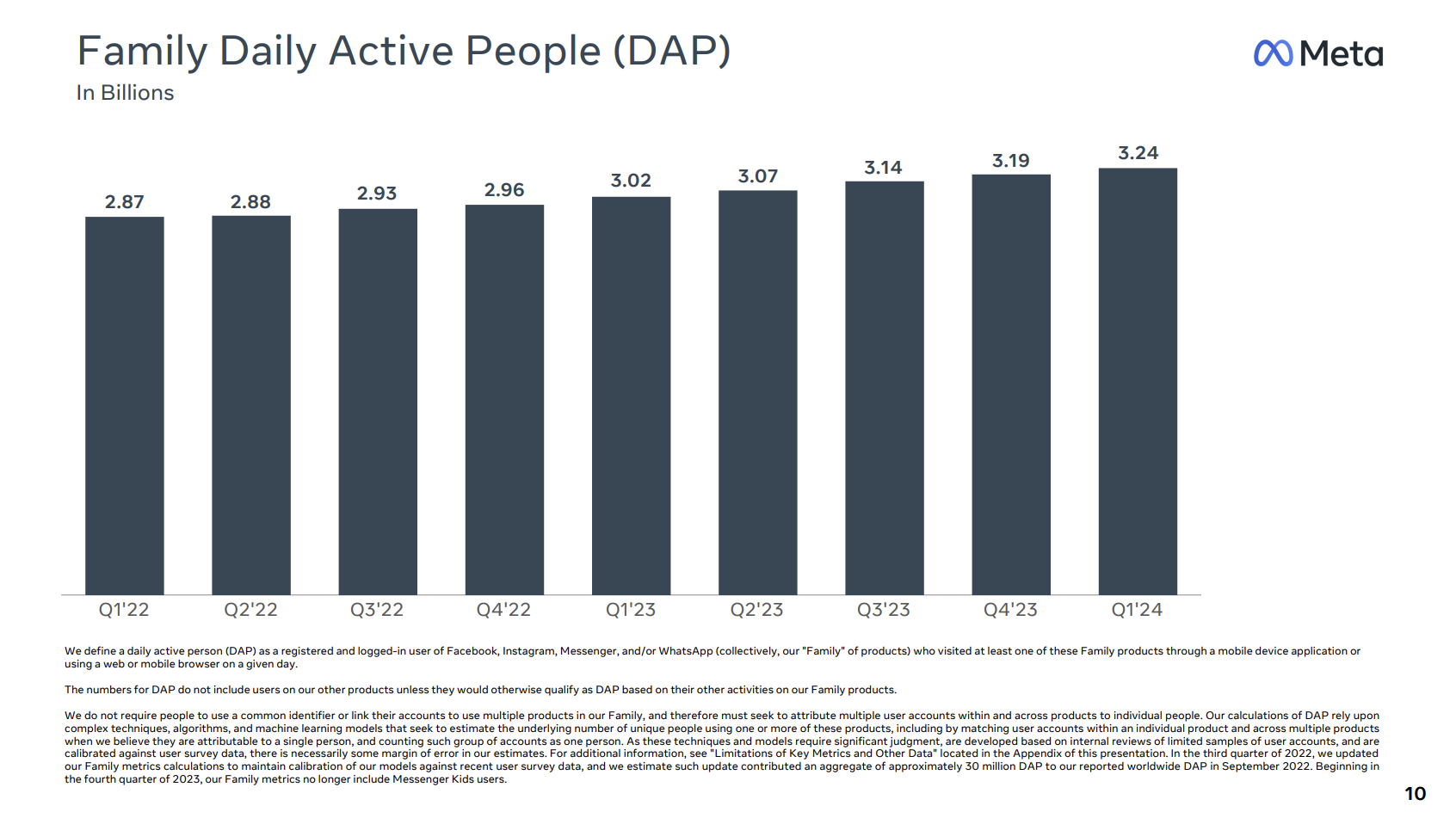

Do keep in mind that Meta now has 3.24 billion daily active users earning over $11 in revenue. Wild.