Although the Amazon streak of new highs did end, they are back to starting new highs on the back of their Q1 earnings. A couple of points stuck out in the client letter I distributed a few weeks back:

1. Product sales slow, SERVICES SERVICES SERVICES - Product sales grew 7% versus service sales growing 17% and now accounting for nearly 58% (vs. 55% in Q1 2023) of total net sales.

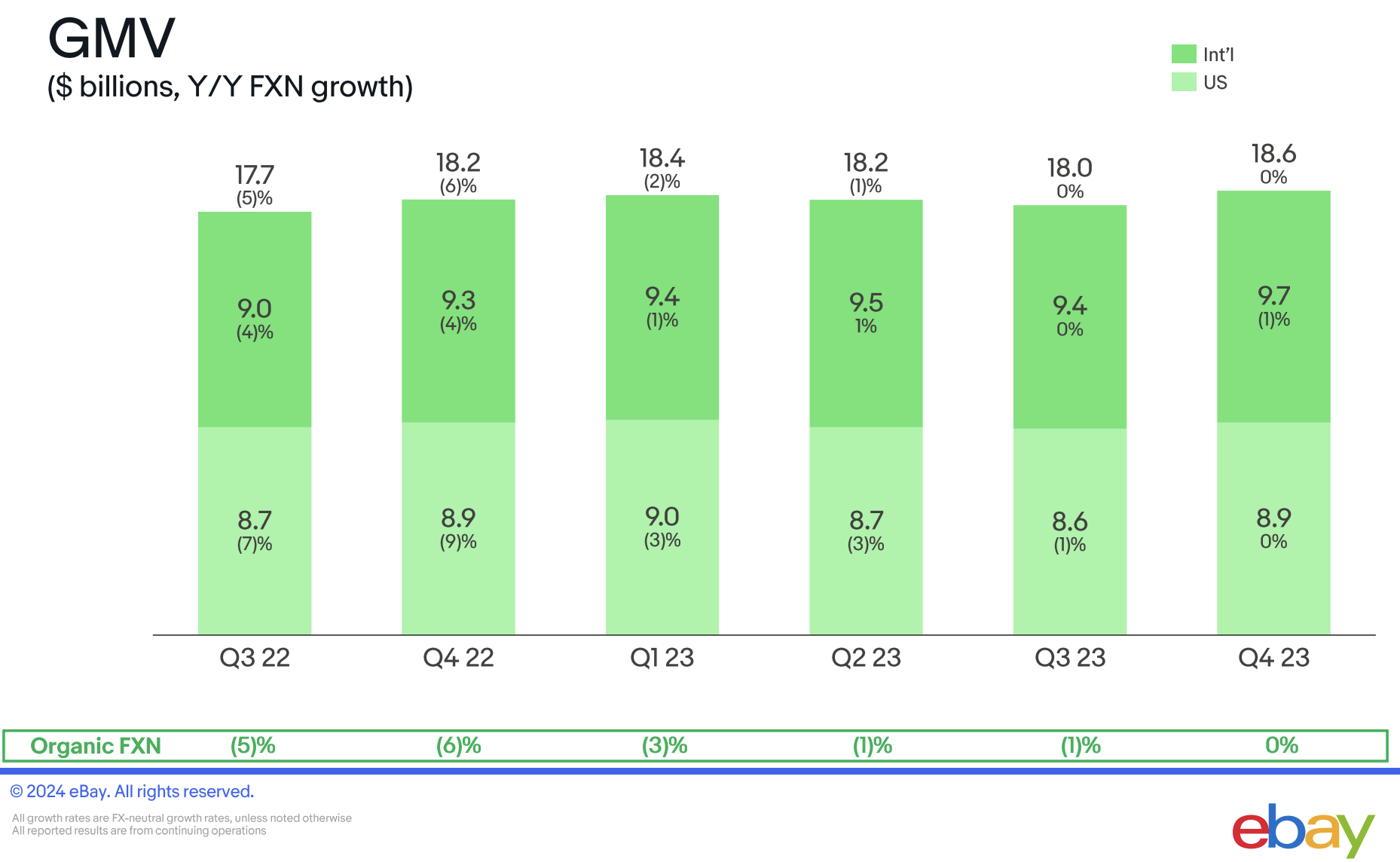

2. International back to growth - US remained flat with last year’s growth rate but International is back with several consecutive of quarters of positive growth. Interestingly, AWS now nearly half the size of Online Stores, the business was only a 1/4 the size 3 short years ago.

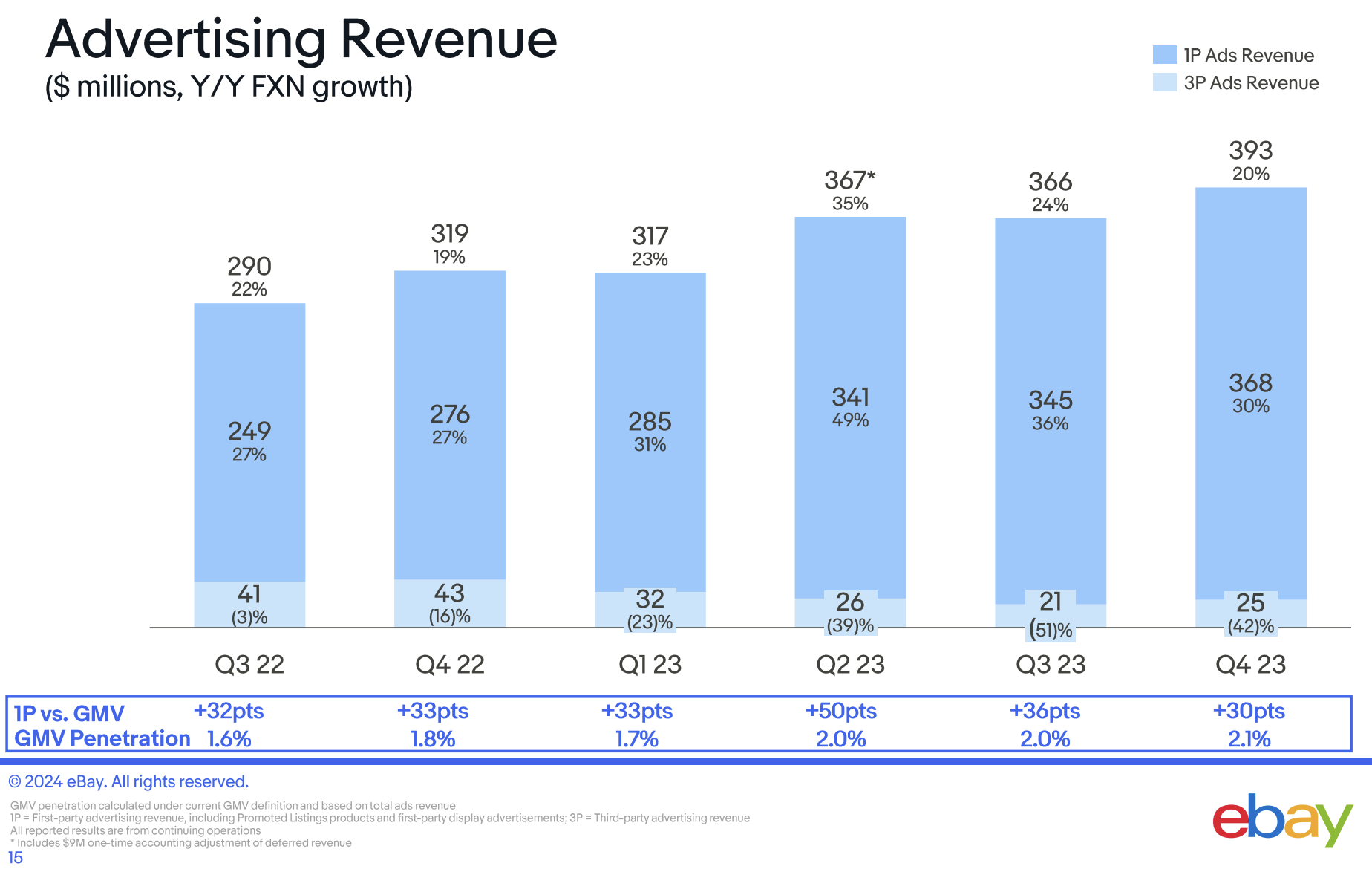

3. Amazon reliant on 3rd party sellers and advertising - Continued strong growth from both 3rd party seller services (aka Seller Central) and advertising. Those two businesses now account for 33% of total sales vs 26% a few short years ago. Recent fee changes likely will mainly be seen in the next quarterly earnings report.

None of these trends are new. Amazon continues to become the “toll booth” of eCommerce and now own nearly 40% of eCommerce. Nothing here to suggest they aren’t continue to build the moat.