Disclosure: I previously worked in Strategy for Hudson’s Bay Company and now run a business focused on Amazon.

“The combined company would have about $10 billion in annual sales, the people said. Luxury behemoth LVMH Moët Hennessy Louis Vuitton, which owns Louis Vuitton and dozens of other brands, had sales of about $94 billion last year.

Amazon would take a minority stake in the new company, which will be called Saks Global, and plans to provide it with technology and logistical expertise, the people said. Salesforce is another minority shareholder. Saks already does business with both tech companies, so the transaction would deepen existing partnerships, one of the people said. ”

It hasn’t been a secret that Richard Baker of Hudson’s Bay Company has had his eyes on Neiman Marcus. As the luxury department stores shrink, the focus is on maintaining the A quality stores, building mass against the luxury brand houses whilst consolidating back office operations and taking a bet on the longer term value of the real estate. Including Amazon in the mix has been a rumor that now seems to be true.

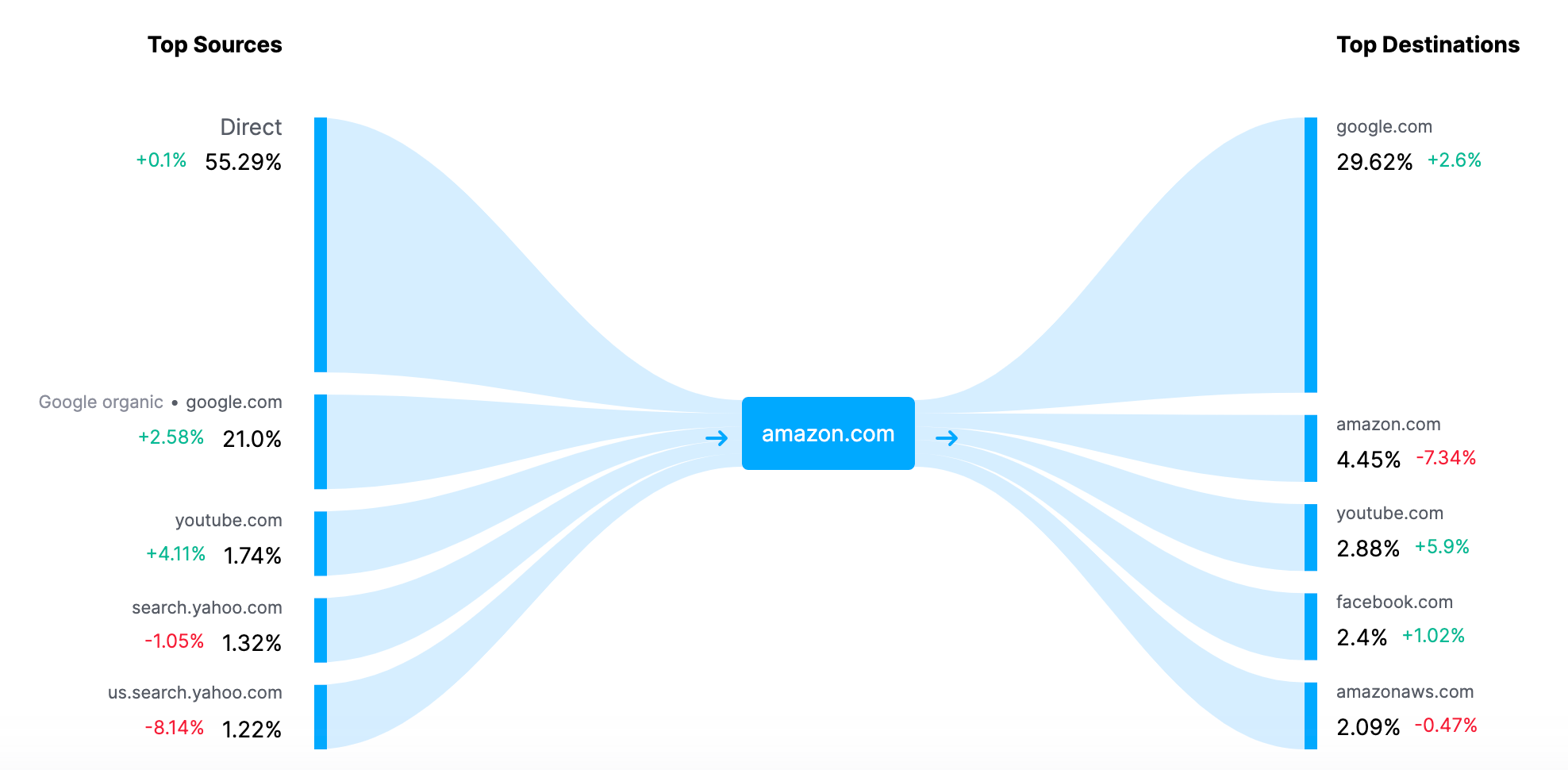

Amazon has long sought success in luxury fashion. There has been the launch of Amazon Luxury, the opening of test stores and the acquisition of flash sale sites that sold off-price luxury like MYHABIT. We know Amazon wants to be the toll booth of eCommerce, continue to face FTC pressure and largely struggled with brick & mortar. This type of deal seems to allow Amazon to run the piping, picks & shovels of brick & mortar plus ease the FTC. Quite an interesting deal.