Recently came across headlines about how Instagram already has more advertisers than Twitter. I believe there are a few reasons:

- First and foremost, Instagram as a platform is HOT. It has growth in users and engagement with ads disguised as user content.

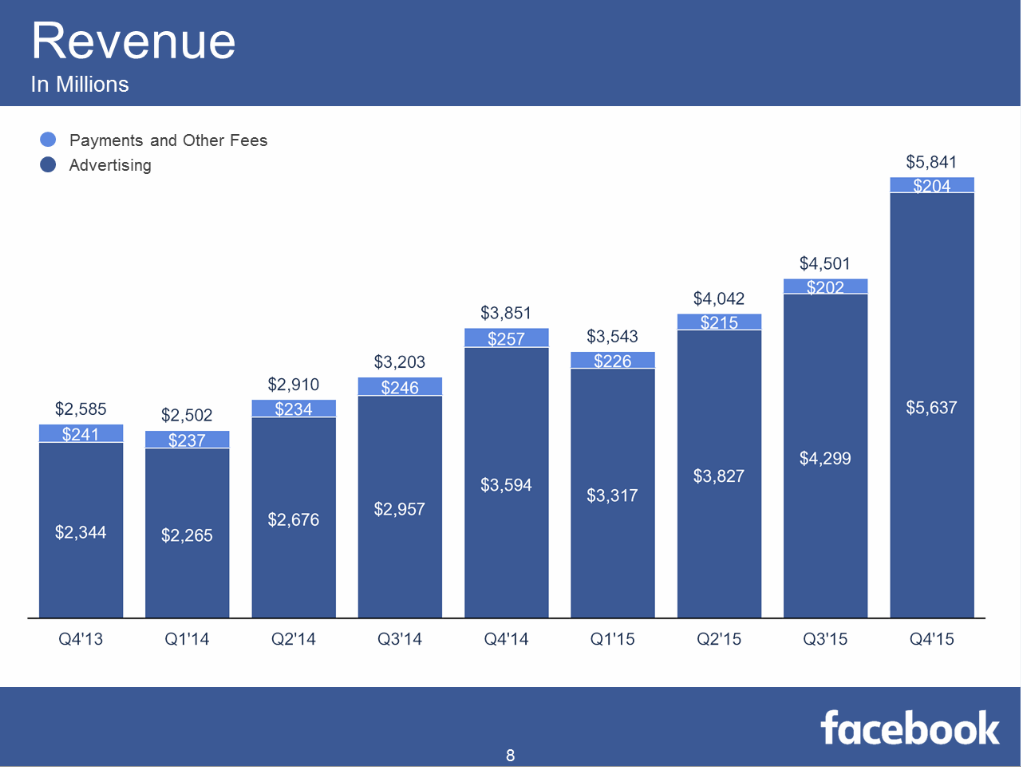

- Dedicated Audience - Facebook has a massive audience that most advertisers are already seeking. By incorporating Instagram into current Facebook advertising accounts, Facebook has added an additional channel with which to advertise on. The deliberate, meticulous, slow moving rollout of Instagram within Facebook as opposed to outside of Facebook was a savvy one.

- Ease of Setup & Refinement - The ease with which marketers can setup an advertising campaign ranging from $1 to $1,000,000 is unmatched. Whether devising advertising campaigns as Analyst or a CMO, anyone can do it.

Here are some screens taking you through the process to show you how easy it really is:

As you can see from the above, integration of Instagram within Facebook Ads Manager is seamless and screams for your attention and $. Leveraging the large network of users and advertisers within an already captive network is why ad dollars continue to shift to Facebook. Look for a similar setup once they "light up" WhatsApp and Facebook Messenger with ads.