Access October Earnings Snippets here.

Earnings season is underway with a few more next week. In no particular order, snippets on some of the top names:

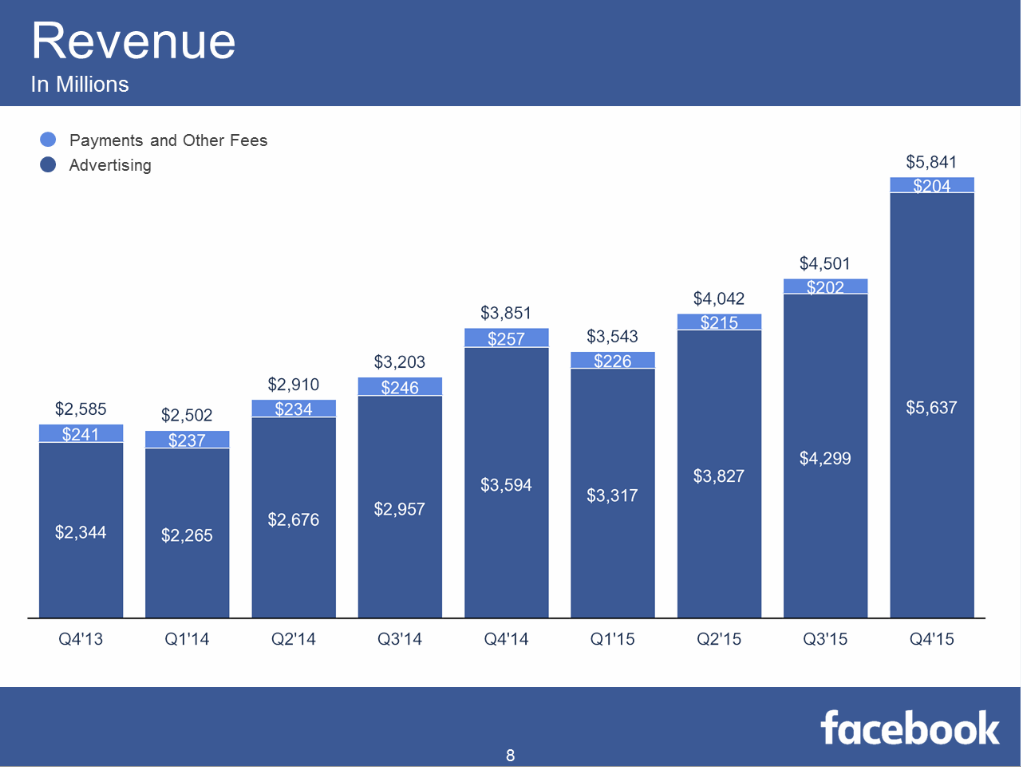

Facebook: Stunning quarter in all respects. Strong user growth, strong growth in average revenue per user, greater leverage on expenses. The majority of legacy media is losing advertising dollars to Facebook and so are Google click ads. Facebook and its' properties of Instagram and Whatsapp have lots of runway.

Amazon: More of the same. 3rd party sales grew more than 2x first party sales, AWS cloud services and Prime memberships continue to skyrocket and fund the longer term business investments. North America is on fire but international growth needs to pickup. Look for the weakness to quickly correct as this one still looks unstoppable.

eBay: Now that PayPal has split from eBay, the only real growth is evident in Stubhub. Marketplaces still has a massive presence, but is growing much slower than the competition. I don't see this changing anytime soon.

Apple: Realizing the hardware gravy train of iPhone can't last forever, Apple eventually got serious about selling services (iCloud, Music, etc.) to vast install base of iPhones, iPads and Macbooks. Items like Beats and Apple Watch will assist to offset the lack of growth at this scale but until a high priced item like a TV, Car or VR headset comes along, top line growth will be difficult to come by. But is that really a problem given where the stock is trading with all that cash and the most ambitious stock buyback in history? No.

Netflix: 130 country launch will be costly in short term. With that said, the underlying margins for the streaming business in the US is improving and the slate of content due to come online in 2016 coupled with the ability to raise prices...this one looks unstoppable even considering the perked up competition.

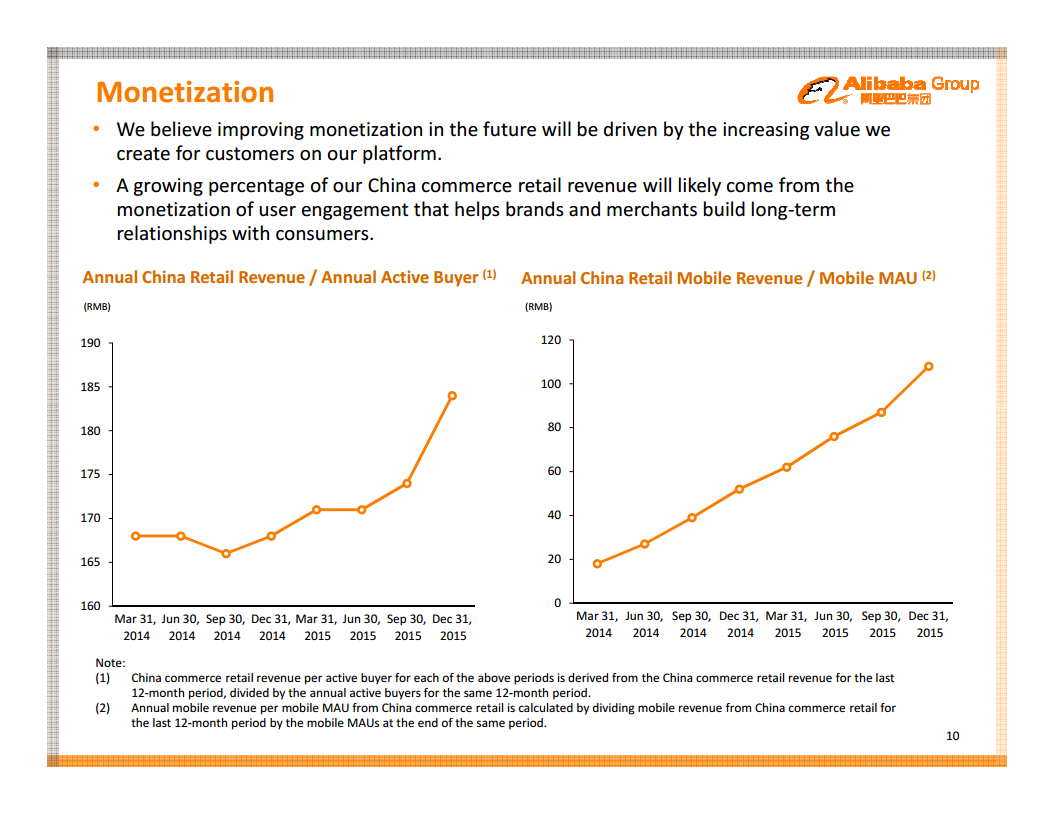

Alibaba: The dominant force of China remains dominant. Strong user growth, strong merchandise growth and improved monetization. Nothing to complain about here.

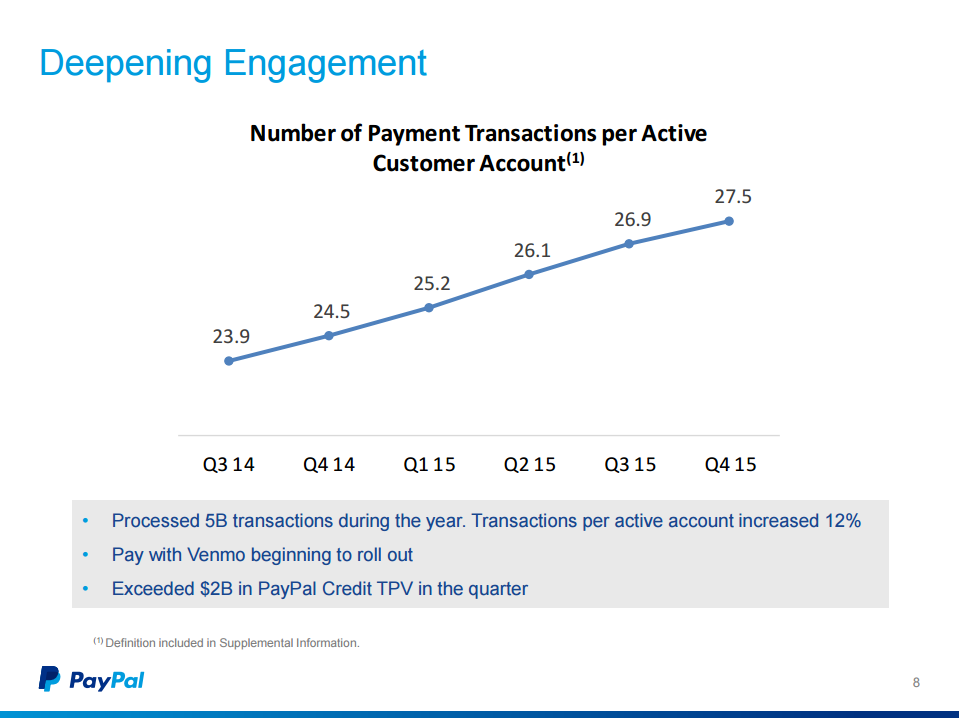

PayPal: Fantastic growth as Venmo and Braintree accelerate. Strong growth, improved number of transactions per active user account and improved operating leverage. Look for continued growth on the backs of their acquisitions.

Some of the slides providing context to comments above can be found below.