Amazon continues to set the benchmark for customer expectations. Same day shipping as part of Prime membership is now available in 500 cities/towns (14 markets). Stats from just a year ago show most customers are willing to wait for shipping if free, but now customers have come to expect expedited shipping for free. There is only one way to pay for that...through membership plans like Prime or building it into the product cost. There is no "free shipping."

The Importance of Speed: Facebook Instant

In Facebook's drive to house more content and provide a better browsing experience, they have launched Facebook Instant. The general idea is to virtually eliminate any load times for content as speed is arguably the number one requirement for success on mobile. The alternative is long load times via browser and high bounce rates/low engagement. Take a look at the difference in story load times compared below.

Whilst this is nothing new and others have deployed solutions within media already, I believe Facebook will be the catalyst to require faster load times from eCommerce sites. Retailers can no longer rely on the mobile browser and must provide a faster experience whether by native app, overlays in other apps or optimized mobile sites.

So this Facebook instant article loaded around seven seconds faster than a Twitter link pic.twitter.com/quSC7kGD5Y

— Matt Roper (@mattjroper) May 13, 2015Desktop vs. Tablet vs. Smartphone

Q1 2015 statistics from MarketLive show improving conversion, average order value and cart abandonment across the board for tablet and smartphone (see chart below). This will continue as mobile payment and single sign on improves.

Jet.com Mystery Shop

With all the headlines Jet.com is receiving and the recent raise of $140 million valuing the company at $600 million, I figured I had to try out the service.

In order to meet the free shipping threshold of $35.00, I decided to purchase a fairly routine purchase of 2 pairs of underwear. The list price was $21.00 per unit but I was able to save several dollars by paying with a debit card and forgoing the option to return the items. Total price was $18.81 per unit for a total of $37.62. Upon checkout, I was told the item would be delivered in 2-5 days from Jet.com Trusted Retail Partner. The order was on 5/2, shipped that same day and delivered on 5/7. Upon receiving the shipment, I found that the items were shipped by Nordstrom. The packing slip and packaging was labeled Nordstrom.

Jet.com Advantages

By acting as a referral platform for other ecommerce stores, Jet.com holds no inventory and eliminates most of the risk most retailers face. The transparent price savings through payment method choice and providing sales with a no return policy allows Jet.com to provide savings to both the customer and retailer. The model is clean and ultimately provides a compelling value to any online shopper that doesn't care about which retailer ships their order.

Retailer Implications

More eyes on products leads to more sales. Better sell throughs lead to more productive inventory. However, retailers are paying for these sales and would prefer the sale to come through their own site. Additionally, the retailer doesn't own the end customer and doesn't have the ability to market to that customer for future orders.

Model Sustainability

The model is sustainable as long as Jet.com drives traffic to their site and retailers are willing to place product on Jet.com. Drop shipping direct to customer is a trend that most brands are familiar with and I believe retailers will continue to fuel online sales using this method.

Bottom Line

Jet.com is onto something. They have replicated the Amazon and Alibaba marketplace model in much cleaner way. Jet.com will be successful earning affiliate fees through sales, eventual membership fees and minimizing inventory risk. If growth ever sputters, they will eventually need to take on inventory.

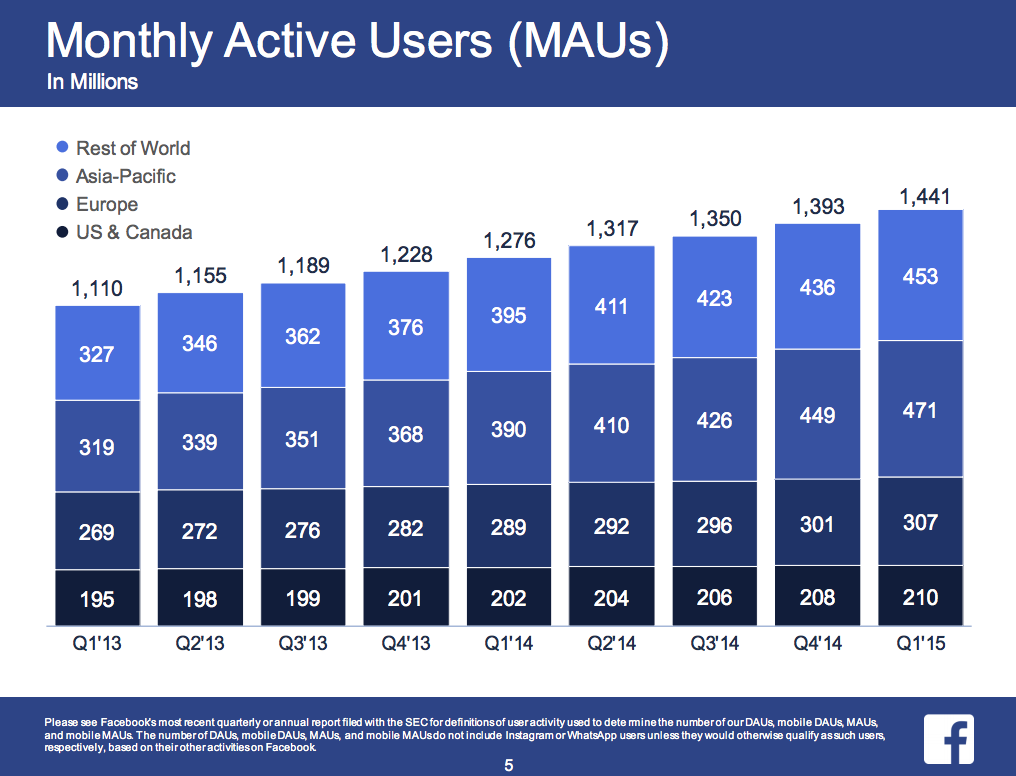

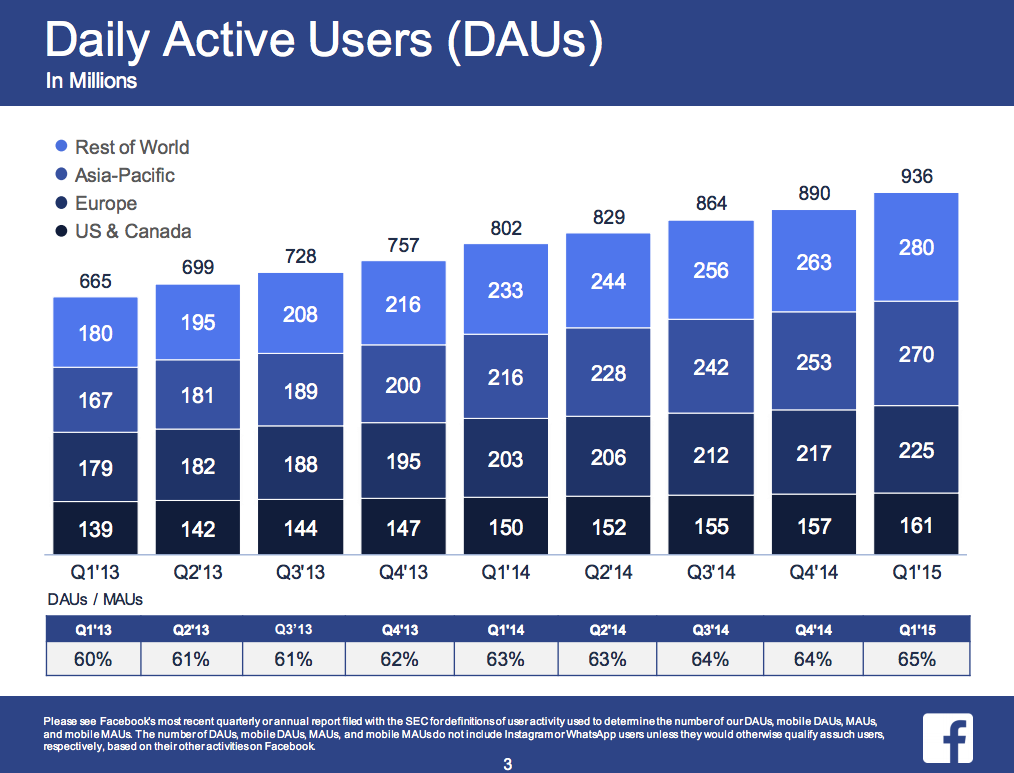

Facebook Numbers

Facebook has fallen out of favor with Wall Street but the numbers reported in the latest quarter are mind boggling. Monthly active users of 1.4 billion of which 65% or 936 million are daily active users. More importantly, the Average Revenue Per User (ARPU) was up year over year in all geographies a minimum of 20%. I am quite optimistic Facebook has just begun to monetize their user base. For context, Google ARPU was approximately 6x Facebook last quarter. A few of the slides showing the scale of the Facebook ecosystem shown below:

State of Bitcoin: Q1

Coindesk, the authority on bitcoin recently published the Q1 State of Bitcoin. Basic takeaways were as follows:

- Number of wallets are up 11% to last quarter and forecast for growth remains intact

- Merchants acceptance growth has slowed considerably

- Transaction volume continues to grow but bitcoin largely remains a store of value

- Price declines will lead to further consolidation within mining

- Led by Silicon Valley, historic investments continue

Bottom line: Consumer adoption remains strong, merchant adoption is slowing and exchange transactions need to strengthen.

In Perspective: Amazon Prime

As an avid customer and advisor for brands selling on Amazon, I continue to be amazed at what the Prime program has become and is becoming:

- Captive: Less than 1% of Prime customers are likely to consider other mass-market retail sites (e.g. Walmart.com or Target.com) in the same online session.

- High Volume: Prime members spend $1,500 annually vs. $625 of typical Amazon customers.

- High Converters: 63% of Prime members carried out a paid transaction in the same visit, non-prime was 13% vs. Walmart.com at 5%.

- Growing: By 2020, analysts predict 50% of American households will be Prime members.

Prime's unapologetic pursuit of simple commerce is clearly ahead of other rivals. Features like one-click checkout, pressing Amazon Dash buttons for replenishment and Prime Now same-day/same-hour shipping continue to lengthen their lead.

Is Convenience Worth The Premium?

Seems each day I come across another company or startup making the sale, delivery or return of goods more convenient. For example: Postmates, Google Express and Instacart provide "on-demand" deliveries for a number of retailers for a fee or slight markup on product. Shyp provides a service that will pickup your eCommerce return, package and ship for you for $5 plus the cost of shipping. These and other companies provide convenience for what is typically a nominal fee.

When catching up on news this morning, I came across a Vancouver store named Pirate Joe's. In the US, Trader Joe's is known for its' quirky attitude but appreciated for low priced, high value groceries. Due to the lack of Trader Joe's in Canada, the owner of Pirate Joe's is able to sell product he purchases across the border in the US for 2X the price. Customers are willing to pay the premium rather than drive 55 miles to the closest Trader Joe's south of Vancouver. It seems business will remain strong as Trader Joe's has no intention of expanding into Canada or opening a cross border eCommerce site anytime soon.

Apparently convenience is truly worth the premium.

Mobile Shopping Research: Apps vs. Mobile Sites

PayPal recently released a mobile research study they ran with Ipsos. There were a few slides that are worth highlighting outlining 3 takeaways: 1) mobile shopping by country varies greatly with NL and CA being <20% buying via smartphone to CN at 68%; 2) although mobile sites drive more dollars, shoppers tend to prefer apps; 3) apps are preferred due to the belief they are more convenient.

Yik Yak Growth Issues?

GigaOm recently speculated there are growth issues at Yik Yak. I would argue this is a small blip. Yes, they are now on EVERY campus in the US, but the MAU metric used focuses on the holiday season. The same time in which college students are usually at home celebrating the holidays with family.

Keep in mind that Facebook started with the campus approach. The real question will be how Yik Yak extends the offering into broader audiences and/or increase engagement. Will they continue to focus on college students with international rollouts? Will Yik Yak broaden reach with a focus on events similar to Snapchat? This is no Secret and there are plenty of uses and growth to come.

Toughest Market for Uber: China

When I was recently in China, I asked several residents if they had heard of Uber. Every single answer was a resounding "no." When showing Uber, many showed me Didi Dache. Some opened the app whilst others pulled up the offering within WeChat. Seeing that Kuaidi Dache and Didi Dache are now joining forces and own 95% of the market, I would assume Uber will struggle to grow and likely only remain a force with foreigners and visitors.

Refreshing Outlook on Airbnb in the UK

Current regulation in London requires anyone interested in renting their unit must gain approval or faces a $30,000 fine per offense. As of Monday, Brandon Lewis, the housing minister plans to eliminate the 42-year-old London law.

“We live in the 21st century, and London homeowners should be able to rent out their home for a short period without having to pay for a council permit. These laws … need to be updated for the internet age,” Lewis said in a statement.

Incredibly refreshing to hear. Hopefully this outlook spreads globally.

"Mobile First" Digital Finance In China

With these new mobile payment technologies, China has leapfrogged both checkbooks and desktop banking. Jane Yang, for example, went straight from paying rent in cash to paying via Alipay. According to PricewaterhouseCoopers, 79 percent of Chinese consumers surveyed said they were happy to receive coupons via their mobile devices, versus just 53 percent globally. And 55 percent of Chinese consumers said they expected their phone to be the main way they made purchases in the future, versus 29 percent globally.

These changes coincide with rising overall incomes in China, and with the government’s desire to build a more consumer-based society, observes Tjun Tang, senior partner and managing director at Boston Consulting Group’s Hong Kong office. “In uptake of digital finance, China is probably leading the world right now,” he says.

I would argue the adoption of mobile payment technologies is mainly due to China's rising middle class using the mobile phone as their FIRST and ONLY computing device used to access these services. This has a profound effect on adoption and highlights why countries like China and India with "mobile first" mentalities will drive innovation elsewhere.

Changing Dynamics of Content Consumption

From John Herman at The Awl:

If in five years I’m just watching NFL-endorsed ESPN clips through a syndication deal with a messaging app, and Vice is just an age-skewed Viacom with better audience data, and I’m looking up the same trivia on Genius instead of Wikipedia, and “publications” are just content agencies that solve temporary optimization issues for much larger platforms, what will have been point of the last twenty years of creating things for the web?

Spot on. The way in which content and media is accessed is changing as we speak.

Distributed, Branded Ads via Twitter

What makes Twitter unique is that Tweets can flow from Twitter to other mediums seamlessly, like TV, websites and mobile applications. In fact, in the third quarter of 2014 there were approximately 185 Billion Tweet impressions off of Twitter. For the thousands of brands already advertising on Twitter, these new partnerships open a significant opportunity to extend the reach of their message to a larger audience. Twitter syndicated ads will be seen by users within Twitter content sections on third-party properties, as well as within third-party content areas.

No other platform is currently providing the ability to serve ads across multiple mediums and applications BRANDED by platform. Are users more likely to click on an ad served in Flipboard that has the Twitter logo (see image above)? I believe so. Why? Familiarity and instant credibility. I as a user know I will be brought to Twitter, the same environment I am familiar with, trust and have positive brand association for.

Will Twitter be successful and see volume with these types of campaigns? TBD, as distribution is key. Flipboard and Yahoo Japan won't be enough...but as the distribution builds, the access to tweets and broader audiences outside of Twitter also builds.

Stores as DCs

"The 83 Wal-Mart Supercenters that are shipping out online orders now handle more than a fifth of the goods bought on walmart.com."

Inventory productivity is up as inventory is brought online and becomes more decentralized. Implications are extensive with each retailer asking the following questions:

- Can our store associates match the productivity and efficiency of our distribution center employees?

- Is the cost of shipment from UPS/FedEx higher or lower with decentralized shipping although shipping may be closer to end customer demand when coming from stores?

- As stores allocate selling space and associate time to fulfillment, what are the implications on selling space and payroll?

- How do we ensure profitability on orders that require split shipments and thus 2x cost of shipment?

- Shrink (inventory loss) rates are much higher at store level. What are the minimums we need to set for products to ensure the fill rate is met?

Retail: "The New Normal"

With the close of 2014 upon us, I thought it would be worthwhile to outline "The New Normal" of Retail:

eCommerce

2013: Strong eCommerce growth with flat store sales

2014: eCommerce growth strong enough to offset negative year over year store sales

Mobile

2013: Mobile visitors account for 25% of traffic and 10% of sales

2014: Mobile visitors exceeding desktop visitors and contributing 30% of sales

Shipping

2013: "I'm not paying for shipping"

2014: "I want it now and I'm not paying for shipping"

Fulfillment

2013: Big box retailers shipping from stores.

2014: Big box retailers shifting selling space and payroll to fulfillment space and payroll.

eTail

2013: "All commerce is shifting to eCommerce"

2014: "When is this lease space available?"

Beacons

2013: "Tracking is an invasion of privacy"

2014: "The bridge of offline and online retail"

Social

2013: Retailers sharing links on social media sites with off app/site transactions.

2014: Twitter, Pinterest, Facebook, Wanelo transactions happen in-app/site.

Taco Bell Mobile Ordering Test Run

I wouldn't consider myself a Taco Bell customer, but given my interest in Square Order, I had to give the new mobile ordering functionality a test run. The app is extremely well designed and provides a thorough overview of locations, menu items and personalization features (see screenshots below).

Once the customer has chosen food items and clicked through to checkout, the customer is required to input their credit card for checkout. Apple Pay is currently not included as an option. Once complete, the customer is alerted of the closest location for pickup and sent an email detailing the order.

Once the customer is in close proximity to the store or ready to pickup the order, the customer alerts the app of in-store or drive-thru pickup. The customer is then provided with a pickup number. In the test I ran, the order was ready for pickup in just a few minutes.

Overall, the experience was seamless and definitely a service I would consider using if purchasing from Taco Bell. With that said, I felt the Square Order experience that uses beacons/wifi to gauge the customer's proximity to the store provided an even better experience. Saving a few clicks is always appreciated.

Given the news of Starbucks launching mobile ordering, fast casual is clearly ahead of retailers in providing seamless, on-demand, self-sufficient experiences that are becoming required in the ever connected mobile world.

Loyal iOS App User Cost

Fiksu has updated their October numbers on the cost of acquiring an app user that opens an app at least 3 times. The upward trend continues with a year over year cost of approximately $2.16 for iOS.

You Are Not the User

Not a frequent user of Google's latest Gmail app Inbox. However, I love to hear that internal design teams are being challenged to realize that design should be approached from the user or end customer's perspective:

In response, the head of the Gmail design team made a presentation entitled "You Are Not the User." If you were not lucky enough to witness the carnage in person you could view its archived version on the internal Google+.