As the Amazon earnings hit the news wire, the stock initially traded up after hours but after sifting through the nearly 20 pages, the forecast drove the stock lower. A few takeaways from the latest earnings release:

The overall revenue grew just under 20% which is a low for a number of years.

Q4 typically sees the lowest growth rates given the large base of retail sales in Q4 in North America.

North America sales saw one of weakest quarters in recent years. I believe this is likely due to Amazon adding in long term storage fees for 3rd party sellers that led to sellers pulling inventory and thus impacting sales. Amazon has since retracted those long term storage fees beginning February 15.

The International revenue was up 15% which is a slight uptick from the 13% posted last quarter. Given recent Indian restrictions being announced, the Q1 forecast is a bit cloudy.

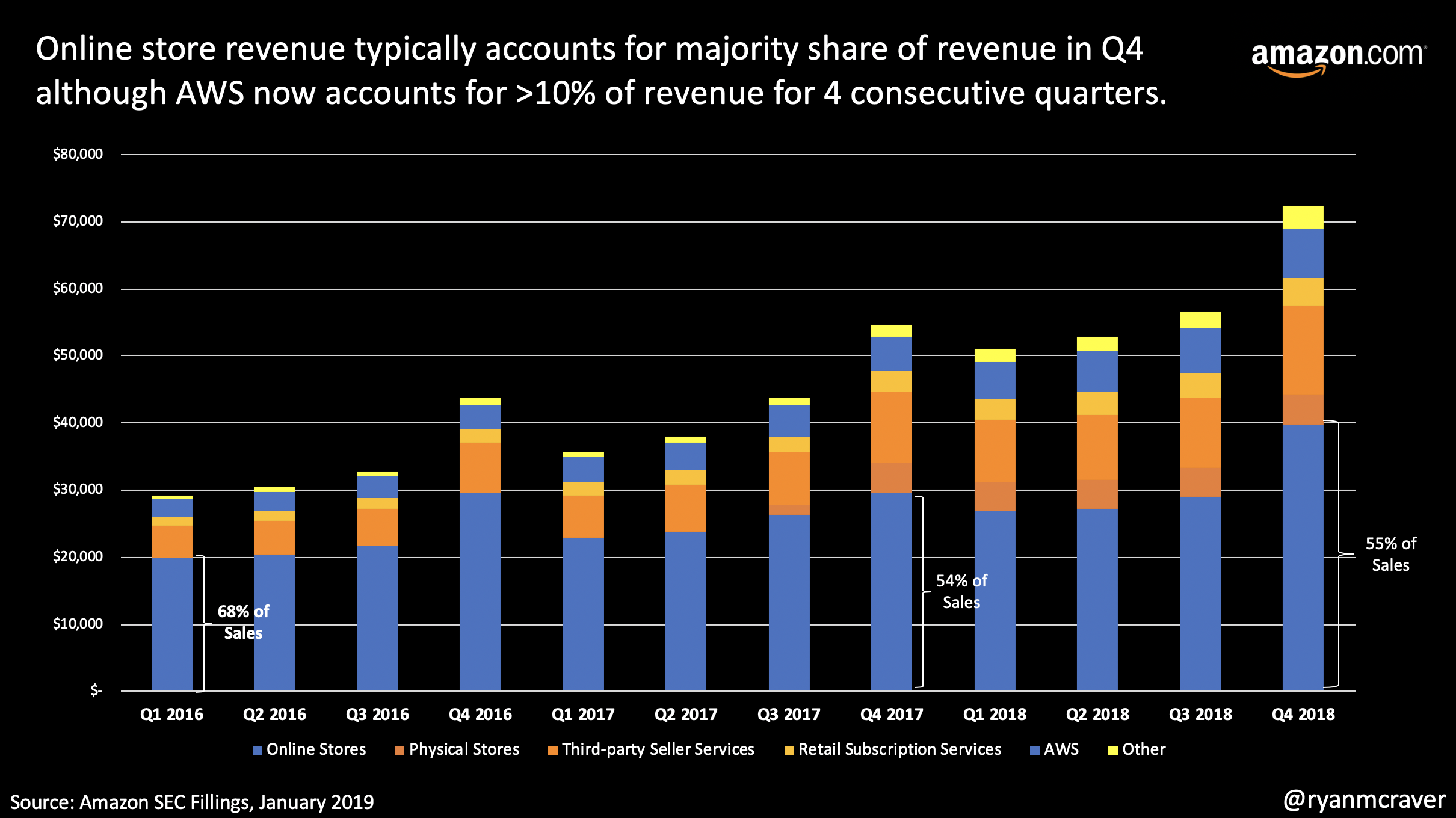

The most profitable businesses continue to have the highest growth rates. AWS has now accounted for >10% of the revenue for the 4th consecutive quarter. The “Other” category that includes Advertising grew 90%+ year over year.

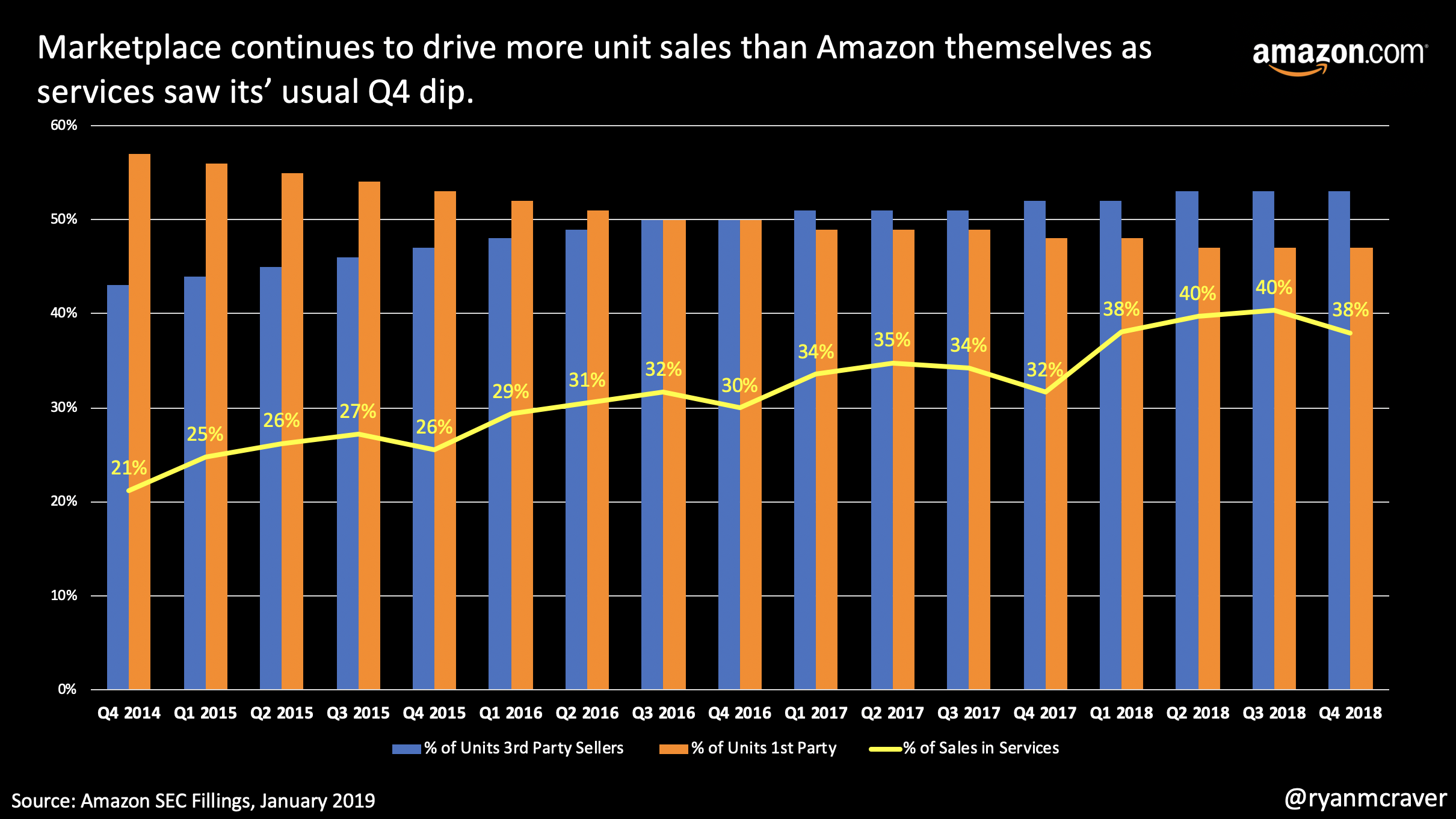

3rd party sales via the marketplace continue to gain share year over year as Amazon pullsback on 1st party owned sales.

Whole Foods/store sales saw a decline as the company calendarized their results and highlighted that any sales driven by Amazon and delivered fall into the online sales bucket.

Bottom line: Whilst the revenue growth numbers were disappointing, Amazon’s key offerings (AWS, Services and Other) continue to grow rapidly and are bringing much desired profitability.