With Black Friday upon us, I thought it would be worthwhile to provide a bit of context on what I believe we are seeing in retail with the latest quarterly earnings:

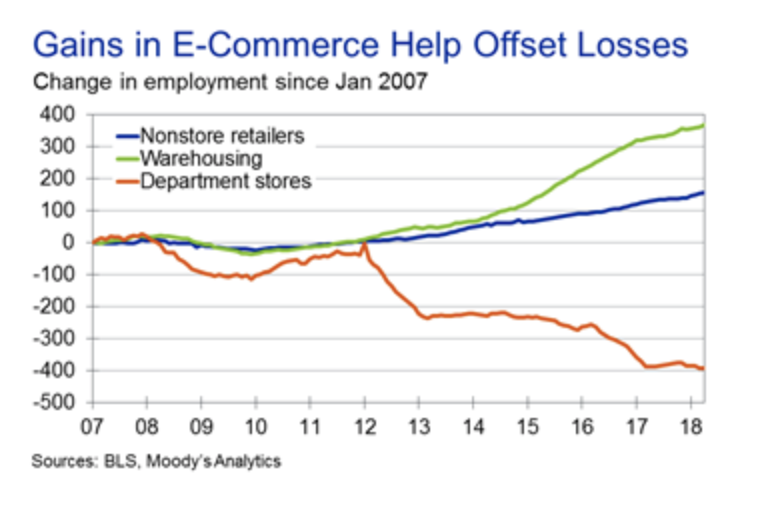

In general, retailers are posting strong results on a sales basis versus what we have seen in previous years. Low unemployment, generally positive consumer sentiment and wage growth are likely the major contributors. Specific niches of retail are seeing a shift of sales from bankruptcies and store closures which has also been accretive. With all of that said, I still believe most retailers still require further store grooming through closures and will face more difficult margins in the years ahead due to the growth of ecommerce.

Target - Strong year over year comp of 5.1% which was down from 6.5% in Q2 (best in 13 years). Of all the retailers, the year over year improvements is most evident in Target. Last year’s comps in Q2 and Q3 were 1.3% and 0.9% respectively. Looking ahead, Target guided a sales comp for Q4 of 5.0%

Walmart - The juggernaut reported a strong Q3 comp of 3.4% with ecommerce growing 43%. With Walmart coming off a 4.5% comp in Q2 (best in 10 years) and muted forward guidance of at least a 3% comp in Q4, investors weren’t that pleased. Walmart’s stake in JD.com also hasn’t helped with the CEO stepping down and some weaker than expected profitability and cloudy outlook. Lastly, the warehouse club arm, Sam’s Club posted a 3.2% comp which was down from 5.0% in Q2. I don’t see anything particularly alarming just believe the stock price got ahead of itself and Walmart’s ability to grow ecommerce share in the US is still a concern especially as the profitability remains difficult.

JC Penney - Disastrous quarter for this retailer who had posted four consecutive positive quarters prior to the -5.4% Q3 comp. I still see plenty of pain ahead marking this chain as the next “on watch” retailer.

Kohls - Another strong year over year comp but deceleration has set in with a Q3 comp of 2.5% versus >3% in previous quarters and 6.3% in Q4. I still find this to be the best mid-tier department store when you compare Kohls to the likes of Dillards, JC Penney and Macys.

Macy’s - 2nd best comp over past several years with a 3.3%. Management was especially rosy on the call about Q4 but only provided slight increases to the low end comp guidance of 2.3%. Ecommerce is firing with additional product added to site and extensive use of buy online, pick-up in store. Macy's is definitely benefiting from a strong consumer but also seeing margin pressure from ecommerce.

Nordstrom - Full line continues to struggle despite last quarter’s pop of 4.1%, their upper end offering posted a measly 0.4%. Their off price offering Rack on the other hand continues to perform well with a 5.8% comp. Nordstrom’s total online business now accounts for 30% of their sales, highest of all the retailers compared here.

TJ Maxx - Both the home offering and main line offering continue to outperform the overall off price sector with a 7.0% comp in Q3.

Ross - A respectable 3.0% comp but TJ Maxx continues to shine and take market share as inventories at Ross have struggled.

Costco - This warehouse chain is on fire, posting nothing lower than a 7.0% comp this year. Q3 was 7.2% and Costco is just starting to tee up their ecommerce offering. With the moat of memberships, this retailer looks poised to continue their assault on retail market share.