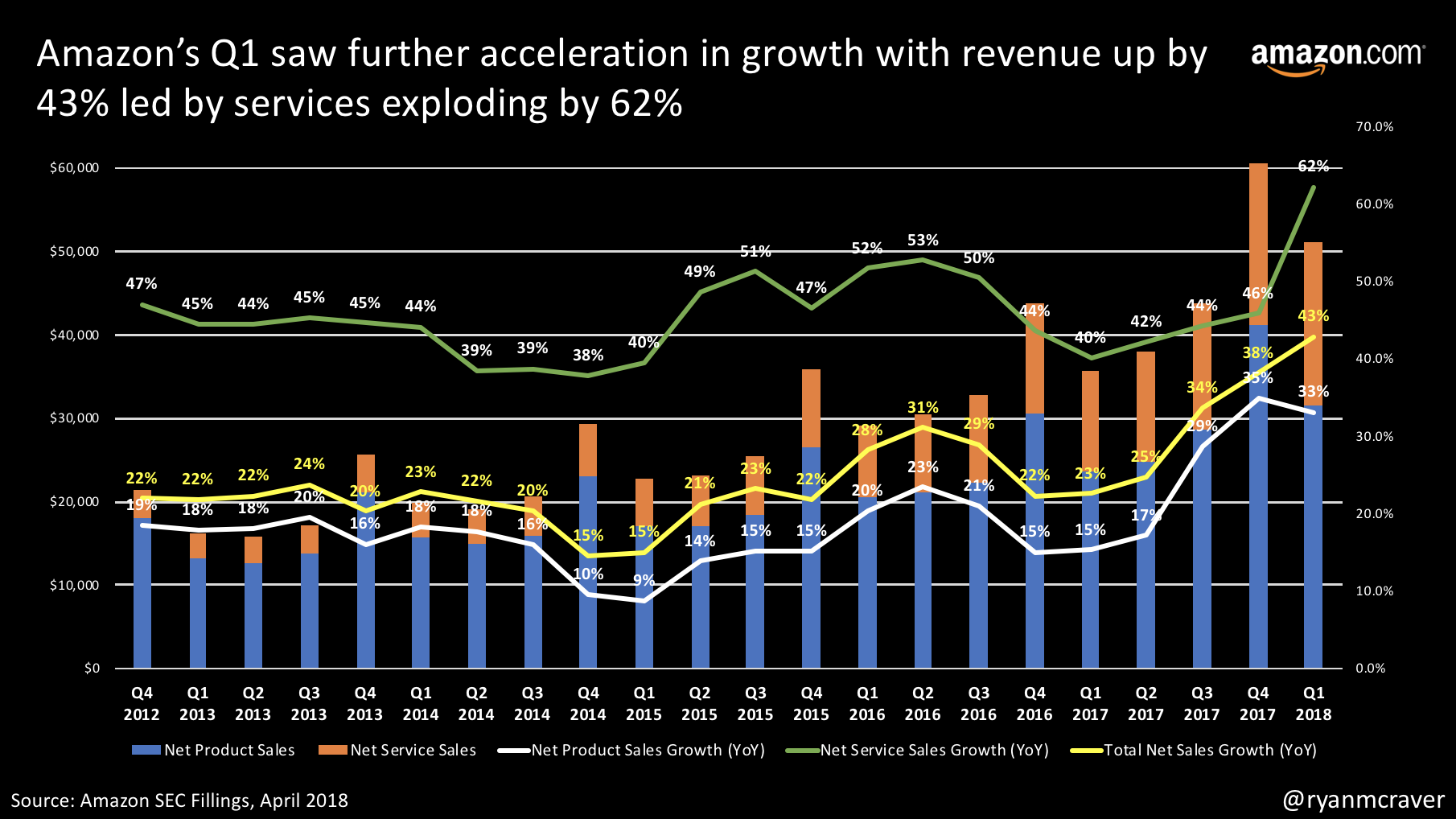

“Competing against Amazon.com “is like racing against Secretariat or playing Michael Jordan,” he said. “A lot of things we were trying to do, they have done better.””

You don't typically see CEO's concede on their ability to compete with other industry players yet the outspoken Eddie Lampert of Sears has done just that. Lampert is not your conventional CEO. Lampert comes from a hedge fund & finance background and has carried out one of the largest real estate wind downs by selling off the low and medium tier Sears/K-Mart stores and spinning the higher tier into a REIT via Seritage Properties. No retailer has been able to compete thus far. Just think about the recent headlines. Walmart sold their Asda stake to pay for their battle with Amazon in India. Bonton is now bankrupt.

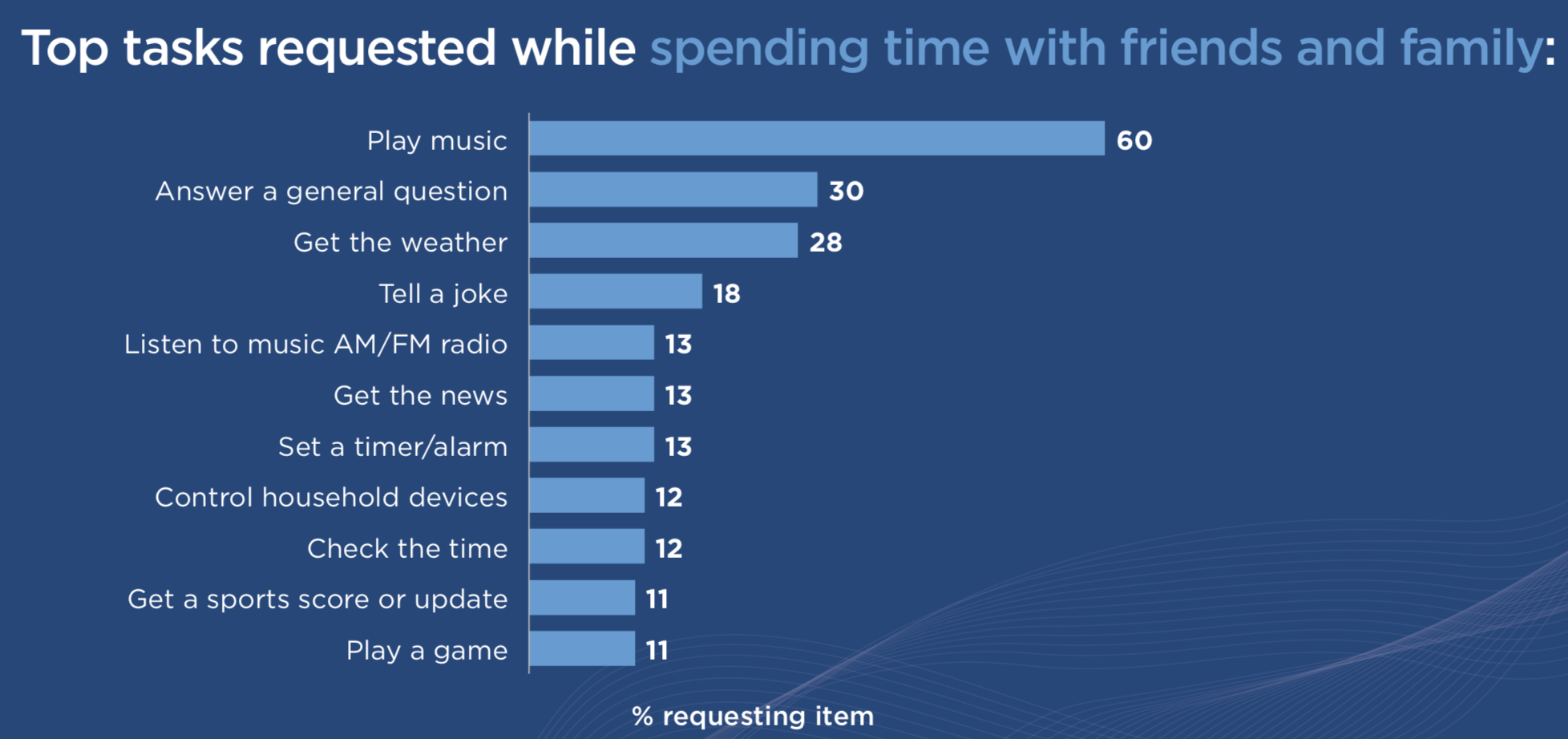

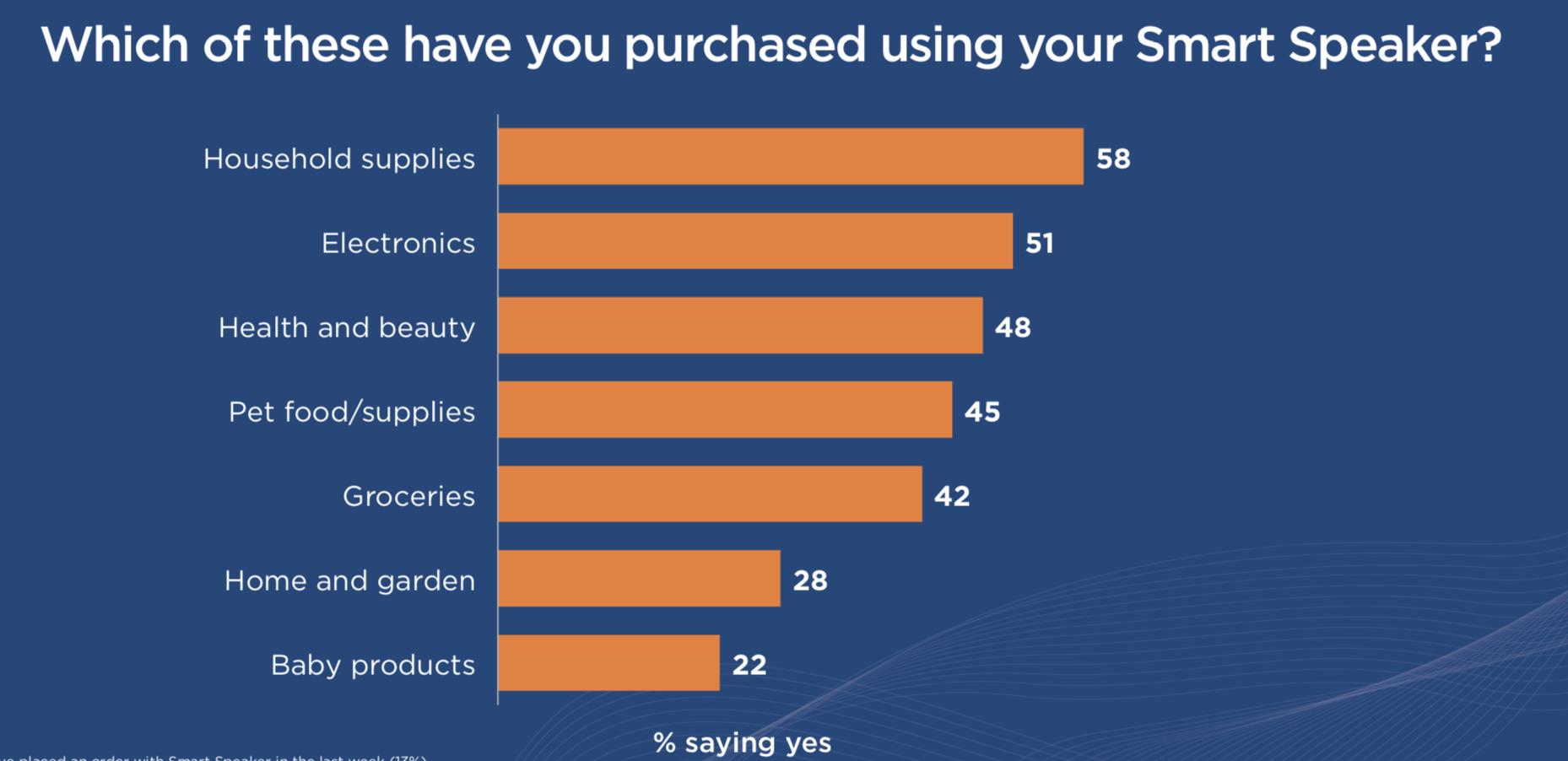

Some retailers realize the impact of Amazon and its reach within retail and outside of retail. Kohl's accepts Amazon returns that have led to positive traffic gains to those specific stores and a completely new customer profile. Chicos understands that 60%+ of the ecommerce growth is via Amazon and decides to list their product. Best Buy understands the importance of their private label and thus uses Alexa as their platform.

Regardless of Lampert's end goal with Sears/K-Mart, his brashness is spot on. No retailer can take Amazon head on and every retailer needs to carve their niche exploiting Amazon.