In two short years, no city or national paper hasn't seen a drop of <19%. Only the Wall Street Journal and NY Times are >500k daily:

It's a Streaming and Facebook World

Latest report from Sandvine shows that 70% of North America traffic is now streaming audio and video which is up from 35% five years ago:

Netflix (37.1%), YouTube (17.9%), and Amazon Video (3.1%), the top three sources of video traffic on fixed access networks in North America, all saw an increase in traffic share over the levels observed earlier in the year

That is an increase of 3% for Netflix and 2% for Amazon in the past year alone. There were also some findings related to Instagram and WhatsApp, both part of the Facebook family:

On mobile networks in the Middle East, Instagram is responsible for over 10% of total traffic. Combining Instagram with traffic from WhatsApp and Facebook, reveals that Facebook controls almost 25% of mobile traffic in the region

WhatsApp, driven by the recent addition of voice calling, now accounts for more than 10% of downstream mobile traffic in Africa

Netflix: It's Raining Content

The year 2015 brought more content. Streaming services like Netflix and Amazon are growing their content the fastest on a much smaller base but basic cable isn't too far behind in their creation.

The year 2016 doesn't look any different. Just take a look at Netflix:

In a recent note to investors, Nat Schindler, an analyst at Bank of America Merrill Lynch, counted all the new shows Netflix is offering this year. He tallied 31 TV series, 10 feature films, 30 children’s shows, 12 documentaries and 10 stand-up comedy specials.

“To put it into perspective, you would have to watch Netflix for 25 days straight to consume all of its new original content next year,” Mr. Schindler wrote.

As Netflix launches into 130 countries their cost leverage for content only improves and it seems as though cost increases in their top countries are justified:

Analysts also expect Netflix to begin raising its subscription fees, which are currently the most attractive in the media business. Customers streamed 12 billion hours of Netflix video during the last three months of 2015, the company says. That means customers paid around 14 cents per hour of Netflix, according to Rob Sanderson, an analyst at MKM Partners.

“Cable is between 25 and 30 cents an hour — so Netflix is basically half,” Mr. Sanderson said. “If you look at the dollars per hour of Netflix, there’s nothing even close.”

Stock price aside, one doesn't seem to need to worry about Netflix subscriber growth, additional content or potential to increase prices. Seems the only worry might be the world becoming awash in too much content.

December Retail Sales

December retail sales were released last week showing a year over year increase of approximately 2.2%. A few takeaways from the report:

- December's sales makes 2015 the worst year for sales growth since 2009

- Big ticket purchases remain strong as autos closed out a record year in shipments and home furniture and building saw impressive year over year increases

- Non-store or internet retailers continued their assault at the expense of department stores and electronics stores

- Bars and restaurants continued to post strong increases and now contributes more sales than grocery stores

Despite the weakness, I don't believe it's nearly as dire as headlines make it out to be. We ended the year in positive territory despite headline sales being negatively impacted by higher housing costs and healthcare costs. With that said, one can't ignore the spend shifts. Departments stores, electronics and grocery continue to lose as spend shifts to non-store retailers and restaurants. Calculated Risk posted the following chart to depict 2015 relative to previous years:

First Trailers, Then Planes, Now Ships.

Latest news on Amazon and their ventures within the transportation industry indicates the filing of paperwork to run ocean liners. Amazon's registration with the Federal Maritime Commission now allows Amazon to operate ocean liners from China into the US and other countries. Why is this news?

Two main reasons:

1. Amazon sellers of all sizes typically purchase or manufacture product overseas, ship the product to their own warehouses and then send off to Amazon for sale via Amazon Prime or Fulfill by Amazon. There are some sellers who will ship directly from their manufacturing facility but those cases are rare. With Amazon running ships from China, sellers could theoretically ship their product from overseas via Amazon and thus skip the step of their warehouse and have the product up and selling on the site much faster.

2. Amazon has a massive hardware business with Fires and Echos. Amazon is also building a private label business named Amazon Basics that includes consumables, apparel and other sought after low cost items. A large majority of those items are likely made in China and could use a lower cost of shipping.

Trailers and planes are for moving products from seller warehouses and between Amazon warehouses. Ocean liners are for moving product from factories/manufacturers to Amazon warehouses. The glut of shipping capacity and ocean liners is an opportunity Amazon is pouncing on as they build the most extensive and aspiration transportation network in the world.

Static Image, Rich Media or Video?

Of images, rich media and video, which is best for mobile marketing?

Schibsted removed some of this guesswork in 2015 by surveying more than 37,000 mobile visitors to its news outlet Aftonbladet about their responses to various types of ad campaigns they saw for products ranging from fast food to luxury cars.

Aftonbladet mobile users saw over the course of a week from ten major advertisers, from Mercedes to Burger King, in three formats: a static image, interactive rich media, and video, for a total of 30 different possible campaigns, each eventually seen approximately 400,000 times. Users then received surveys based on the variety of ad campaigns they ultimately saw (the work here was carried out in partnership with Lund University in Sweden).

The study revealed that the most effective of these formats was the static image. Static banner ads had the greatest effect on a reader’s preference for a brand and intent to purchase the item advertised — and those are among the categories that matter most to advertisers who, at the end of the day, want to sell something.

Keep it simple.

Liberation of Brands: Huge Opportunity

In 2016's Retail Trends, I made mention of brands making further progress in "owning the conversation" with the end customer by going direct. This trend has been underwear for several years but has truly become a focus more recently. The opportunity for brands can be summarized in the following graphic from L2 highlighting direct sales vs. department stores sales:

This time is different.

Concerns about GameStop aren’t new. As long ago as 2011, short seller James Chanos was recommending a bet against the stock.

Mariann Montagne, a senior investment analyst at Gradient Investments LLC, which bought the stock last year and sold in August, said doubts about GameStop’s future tend to come in waves.

The stock has been depressed and it seems due for a bounce based on the high level of pessimism. However, we are delaying the inevitable. This time is different. Gaming consoles with bigger hard drives, homes with more bandwidth and publishers seeking a larger portion of the sales pie equals disaster for a company delivering a majority of profit from physical game sales (new and used).

Innovation Award: Dominos Pizza

How much innovation exists within the pizza delivery business? Quite a bit when you look at Dominos. This $2 billion plus pizza chain is a step ahead of peers with innovation improving productivity and improving the customer experience. Can't help but be impressed with a company that publicly stated mobile is a key focus back in 2007. A few product highlights over the past few years:

- 2007 - Online and mobile ordering launched

- 2008 - Pizza tracker launched

- 2009 - Think Oven launched providing crowd sourced topping ideas

- 2013 - Pizza profiles launched allowing for 30 second ordering

- 2014 - Voice ordering with Siri like responses launched (Link)

- 2014 - 3D pizza app ordering launched

- 2015 - Customized SUV's carrying up to 80 pizzas with integrated ovens launched (Link)

- 2015 - One-tap mobile ordering using Apple Watch launched

Truly impressive how innovation is a foundation of their culture. Some launches have failed, but each release seeks to improve the customer experience and increase productivity. A faster, transparent, more convenient experience pays dividends in many ways. Think innovation assisted with the stock price over the past several years?

Retail in 2016: Industry Trends

The first in a series of posts on 2016 predictions within retail is here. Over the course of the next few days, I will outline industry trends (below), tech trends impacting retail and specific retailer predictions.

Industry Trends:

- Retail sales growth will remain tepid - Spending will continue to be hampered by consumers paying more for healthcare and housing. Pockets of strength will be restaurants & bars, non-store retail (online), auto and home improvement.

- Discount & Outlet vs. Department Stores - The "perceived deal" and "the find" will continue to earn customer wallets. The only way to provide both of those two is through discount & outlet stores...much to the dismay of department stores.

- Cheap chic reigns supreme - H&M, Uniqlo, Zara, Forever 21 and now Primark will continue to drive the mindset of the consumer and steal share from legacy retailers. Mindset: Apparel should be cheap and viewed as disposable.

- Ecommerce is truly here - Although brick & mortar still owns the overwhelming majority of spend, 2015 truly made the customer comfortable with shopping online. Online grocery shopping truly became available and mobile sites/apps hadn't reached the tipping point. That all changed in 2015 and will make previous year's growth seem small.

- Marketplaces thrive - Shoppers start their shopping in a search engine or at a site named Amazon. Sometime in 2016, 50%+ of everything purchased on Amazon will be from a 3rd party seller. Brands will realize the need to list in these marketplaces or risk losing the "eye share."

- Minimal retail footprint downsizing - Although most industry pundits agree that North America has too much retail space, we likely won't see much downsizing in 2016. Stubborn retailers will still open stores in smaller sizes and hope to steal market share from competitors. 2017 will be a different story...

- Liberation of brands - Brands will make further progress in "owning the conversation" with the customer as they focus on selling direct and cutting out the middle man. Some will earn organic sales due to being front of mind whilst others will realize paying for awareness is addictive and expensive.

- Etail is a losing game - It has become increasingly more difficult to run a retail business as 100% ecommerce. With the cost of acquiring an order and/or customer increasing monthly, etailers cannot survive paying for every order. The existing etailers realized this in 2015 by focusing on marketplaces/services to pay the bills.

- Shippers with deep pockets survive - Customers are no longer willing to pay for shipping yet want the product now. Large, comprehensive delivery networks are costly. The Instacarts and Delivs of the world can survive in highly dense markets but the end of domination by FedEx and UPS using USPS for final mile delivery is nowhere near.

November UK eCommerce Sales: 15% of Retail Sales

For the time period of November 1 to November 28, eCommerce accounted for 15% of retail sales. Notice that the data did not include Cyber Monday:

Online sales made up 15.2% of total sales in November, the highest share since records began in January 2008, according to the Office for National Statistics. This year, consumers spent 1.1 billion pounds ($1.64 billion) on Black Friday, up 35.8% from 810 million pounds in the same period a year ago, according to data from IMRG and web measurement firm Experian.

Also note the dominance of Amazon as the commerce point of entry:

And when Britons do shop online, they increasingly turn to Amazon.com Inc., No. 1 in the Internet Retailer 2015 Europe 500. A BloomReach survey of 1,000 U.K. consumers on holiday shopping behavior finds that 90% of them will consult Amazon on their gift purchases this year, using it as a search engine and gift idea generator: About 43% named Amazon as the starting point when they knew what they wanted to get a person, and 41% said they turned to the online retailer as the starting point when they didn’t have a gift idea.

Amazon also ranks highly for comparison shopping. 46% of U.K. consumers will comparison-shop on Amazon for about half of their holiday purchases, and 80% of those surveyed will buy from Amazon, BloomReach says.

Cash-Free Society

Sweden is quickly progressing to a cash-free society. Similar to SMS adoption, other countries are inevitably headed in the same direction:

This tech-forward country, home to the music streaming service Spotify and the maker of the Candy Crush mobile games, has been lured by the innovations that make digital payments easier. It is also a practical matter, as many of the country’s banks no longer accept or dispense cash.

Bills and coins now represent just 2 percent of Sweden’s economy, compared with 7.7 percent in the United States and 10 percent in the euro area. This year, only about 20 percent of all consumer payments in Sweden have been made in cash, compared with an average of 75 percent in the rest of the world, according to Euromonitor International.

Last year, Swedish bank vaults held around 3.6 billion kronor in notes and coins, down from 8.7 billion in 2010, according to the Bank for International Settlements. Cash machines, which are controlled by a Swedish bank consortium, are being dismantled by the hundreds, especially in rural areas.

Even churches are taking the predominate portion of donations via credit/debit and SMS:

During a recent Sunday service, the church’s bank account number was projected onto a large screen. Worshipers pulled out cellphones and tithed through an app called Swish, a payment system set up by Sweden’s biggest banks that is fast becoming a rival to cards.

Other congregants lined up at a special “Kollektomat” card machine, where they could transfer funds to various church operations. Last year, out of 20 million kronor in tithes collected, more than 85 percent came in by card or digital payment.

Why so much investment in same day and next day shipping?

Why are the likes of Amazon and Google so heavily investing in same day and next day shipping? One reason, traffic and buying shifts to stores as the holiday approaches. Take a look at the order volume November (red line) vs. December (blue line) as Christmas approaches for one of our brands. The days of the month are the horizontal axis:

Holiday Inflection Point

With this year's total retail sales expected to be up 3%, there is only so much growth to go around. With the stats from RetailNext on store sales, it seems as though everything has gone to eCommerce thus far:

Sales at physical stores fell 6.7% over the most recent weekend, while traffic declined 10.4%, according to RetailNext, which collects data through analytics software it provides to retailers. That is worse than the 5.8% decline in sales and the 8% drop in traffic recorded from Nov. 1 through Dec. 14.

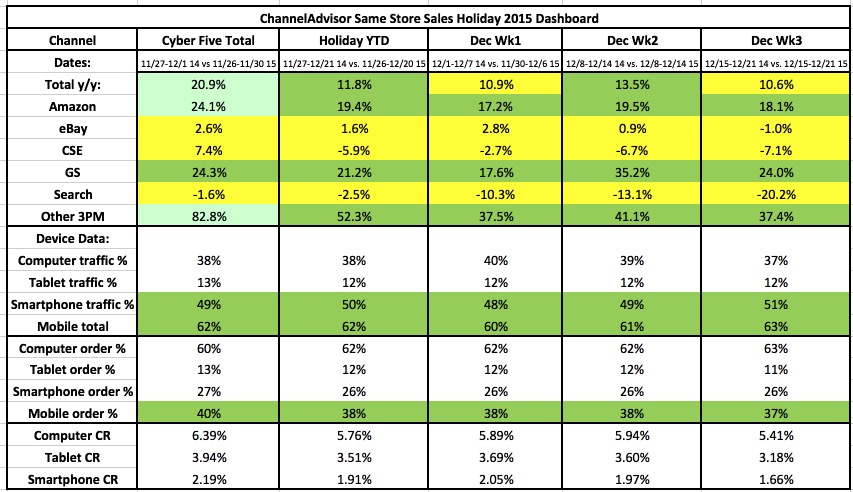

Within eCommerce, Amazon has been the clear winner according to ChannelAdvisor. Google is seeing high growth in Google Shopping but that growth is largely as the expense of their lucrative Google Search business:

Revisiting "The New Normal" of Retail in 2015

Last year, I outlined "The New Normal" of Retail which largely focused on increased mobile usage, small stores and more immediate shipping. I thought it would be worthwhile to outline 2015 prior to releasing 2016 predictions later this week:

eCommerce

- 2013: Strong eCommerce growth with flat store sales

- 2014: eCommerce growth strong enough to offset negative year over year store sales

- 2015: Many traditional retailers saw weak year over year sales as store sales losses were only partially offset by eCommerce sales

Mobile

- 2013: Mobile visitors account for 25% of traffic and 10% of sales

- 2014: Mobile visitors exceeding desktop visitors and contributing 30% of sales (contribution)

- 2015: Mobile visitors now exceed physical visits

Shipping

- 2013: "I'm not paying for shipping"

- 2014: "I want it now and I'm not paying for shipping"

- 2015: "I want it now and if I decide to pick it up at the store, I should have dedicated parking and no queue."

Fulfillment

- 2013: Big box retailers shipping from stores.

- 2014: Big box retailers shifting selling space and payroll to fulfillment space and payroll.

- 2015: Capital expenditures shift to distribution centers and outlet store openings.

eTail

- 2013: "All commerce is shifting to eCommerce"

- 2014: "When is this lease space available?"

- 2015: "Buying sales is expensive, time for layoffs."

Beacons

- 2013: "Tracking is an invasion of privacy"

- 2014: "The bridge of offline and online retail"

- 2015: "We are waiting until Google allows for app-less engagement."

Social

- 2013: Retailers sharing links on social media sites with off app/site transactions.

- 2014: Twitter, Pinterest, Facebook, Wanelo transactions happen in-app/site.

- 2015: No posts are "free," everything is sponsored.

NYT: "Turning Point for Video Game Industry"

Over the past 6 months I have posted why Gamestop's toughest years are ahead, why Gamestop is the IBM of Retail and signs that digital downloads are at an inflection point. Today, the NY Times reiterated a lot of the same thinking:

A number of factors are at play, but none as significant as the industry’s march toward a future of games downloaded over the Internet rather than bought in stores, analysts said. All mobile games are delivered over the Internet, as are nearly all PC games. But the transition for console games — the biggest segment of the business — has been far slower. Large game files could take hours to download and quickly fill a console’s hard drive.

Now, faster broadband speeds and the bigger hard drives in the latest generation of consoles are reducing those obstructions.

I still believe this is the tip of the iceberg and faster broadband speeds are only one reason consumers are flocking to digital downloads. Early release windows, early trial periods, game incentives and ease of purchase are all reasons as to why customers prefer digital downloads. Publishers will continue their assault on the retailers for a few reasons:

- Publisher Take Increases: The Publishers make money by selling directly to the consumer through the consoles.

- Used Game Market Is Minimized: The more digital downloads the lower the amount of used games that can take away from new purchases.

- Owning the Customer Relationship for Future Marketing

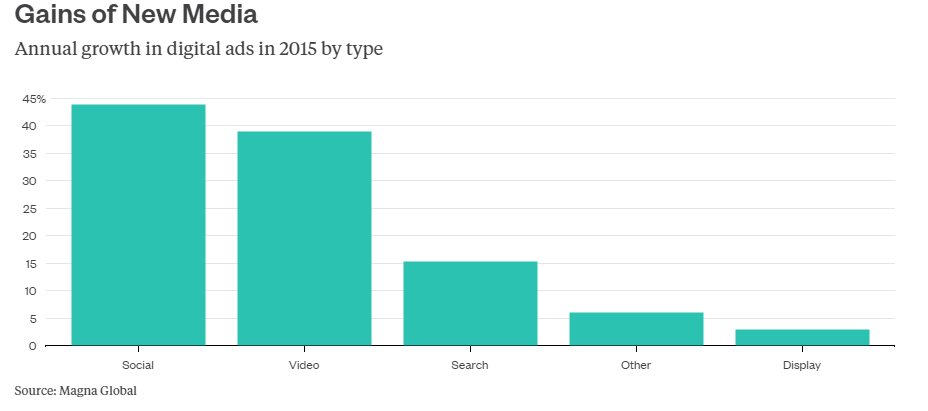

Digital Ad Growth

Bloomberg recently posted a few charts on the growth of digital ads vs. traditional ad formats:

Digital is expected to become the biggest global ad segment by 2017, beating out the category's king, television, according to new Magna Global data. Currently, 38 percent of global ad spending is on TV, while about 32 percent is digital.

Global ad revenue will be about $503 billion this year, according to Magna, and is expected to increase to $544 billion in 2017.Digital media saw the largest increase in ad sales this year among competing platforms, with a growth rate of 17.2 percent. Newspapers and magazines had decreases (-8.6 percent and -10.1 percent, respectively). Growth on other advertising platforms, including TV, was basically flat. Mobile currently makes up about a third of all digital ad spending; it’s expected to be nearly half of the total digital spend by 2017.

Cross Border Commerce: Canada

Day trips into the United States this year are down 26 per cent, rivalling some of the sharpest drops on record. The loonie’s historic slide over the past year or so “has completely reversed the tide of cross-border shoppers,” Sal Guatieri, economist at Bank of Montreal, says.

Amazon Logistics

Per the Seattle Times, Amazon is looking to lease more than just trailers:

Amazon.com is negotiating to lease 20 Boeing 767 jets for its own air delivery service, cargo industry executives have told The Seattle Times.

Leasing 20 jets would be a significant expansion of an Amazon trial operation out of Wilmington, Ohio, according to sources. A cargo industry source said Amazon expects to make a decision to go beyond the trial run and pull the trigger on a larger air cargo operation by the end of January.

The cost of the operation wouldn’t be cheap either. Leasing newly built Boeing 767F jets runs to $600,000 to $650,000 a month, according to cargo industry experts. With so few of those jets available, Amazon would likely turn to lease partners to pick up used converted freighter jets. Those cost about $300,000 to $325,000 per month to lease.

Can't stop, won't stop.

Half of online shoppers check Amazon most of the time...

Although only 800 survey results, couldn't resist how important Amazon is to the online shopper journey:

Consumers were asked how often they search for products or check prices on Amazon when they shop online. Some 24 percent of online shoppers said “always,” and another 25 percent said “most of the time.” That means Amazon has managed to lure some 49 percent of online shoppers to consistently consider their site. (And still another 26 percent said they “sometimes” search Amazon.)