Disclosure: I have a personal position in Robinhood common stock.

Since I previously wrote about Robinhood in July 2024, the stock has seen a 126% increase. Despite the dramatic rise, I still find the company to have significant growth ahead. There were a few points I outlined in July that I thought were worth checking in on:

Assets Under Custody/Net Deposits - Assets saw an increase of 88% in the latest quarter versus last year. A significant portion of the increase was due to higher equity and crypto valuations BUT overall net deposits are up 42% on an annualized basis.

2. Gold Stickiness - In Q4 of 2023, the Gold subscription rate was 6.1%. In the latest quarter, Gold subscriptions as a percent of funded accounts was 10.5%. The platform continues to become a sticky one to leave as the retirement accounts grow.

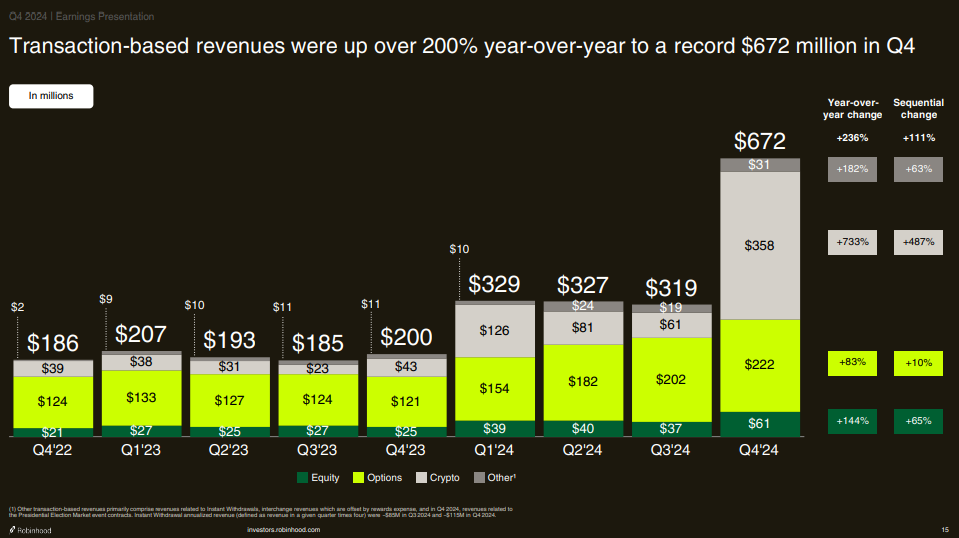

3. Crypto Reliance - The one major callout of the quarter was the increased reliance on crypto to drive the revenues and EBITDA. In Q4 2023, crypto accounted for 21% of the overall revenues versus the latest quarter exploding to 53%.

Clearly the growth story remains intact. However, the stock truly remains a crypto proxy until we see total revenues via options, equity and other means significantly exceed that of crypto. Regardless, there is more left in this one and I continue to bullishly hold.