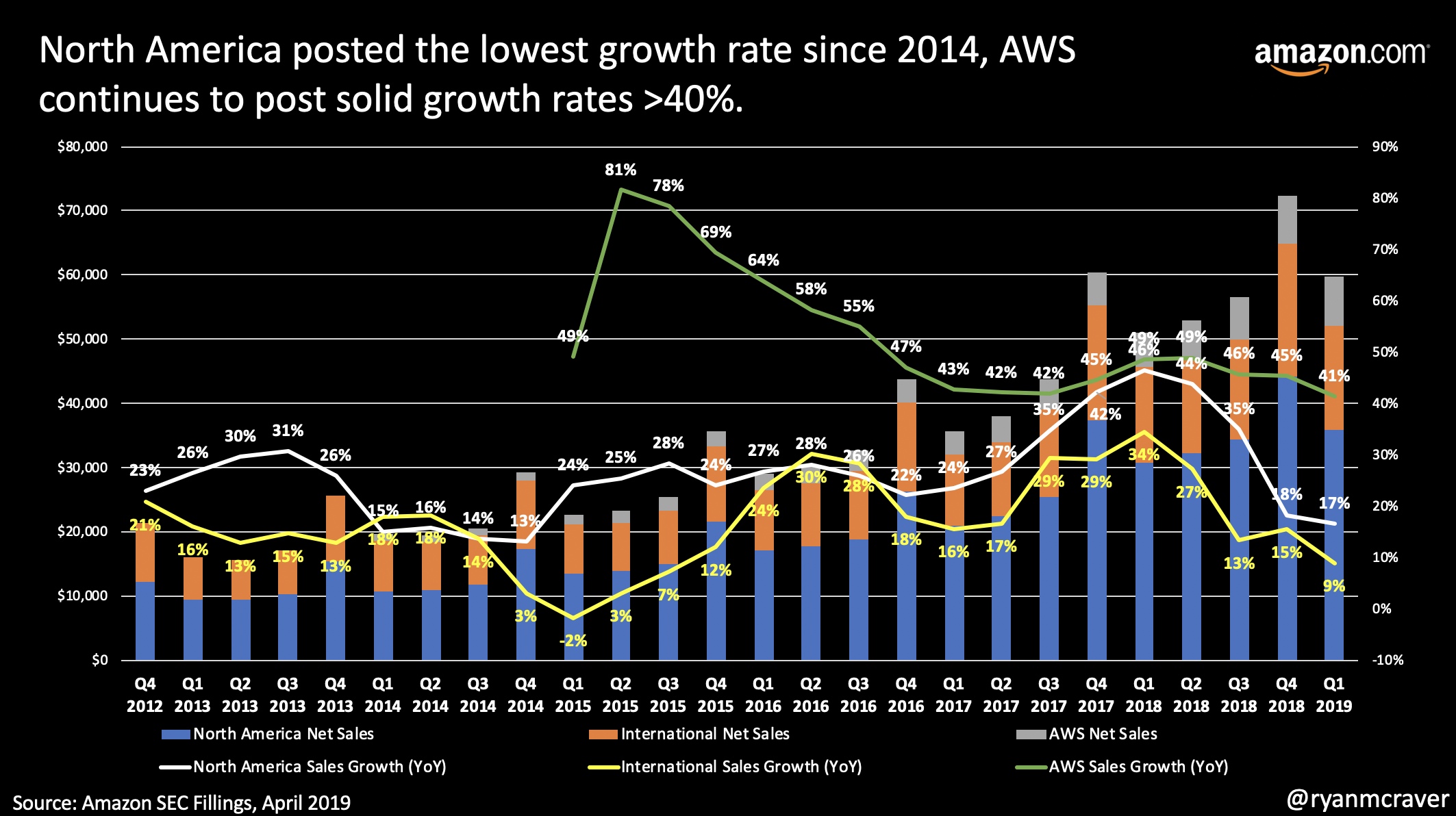

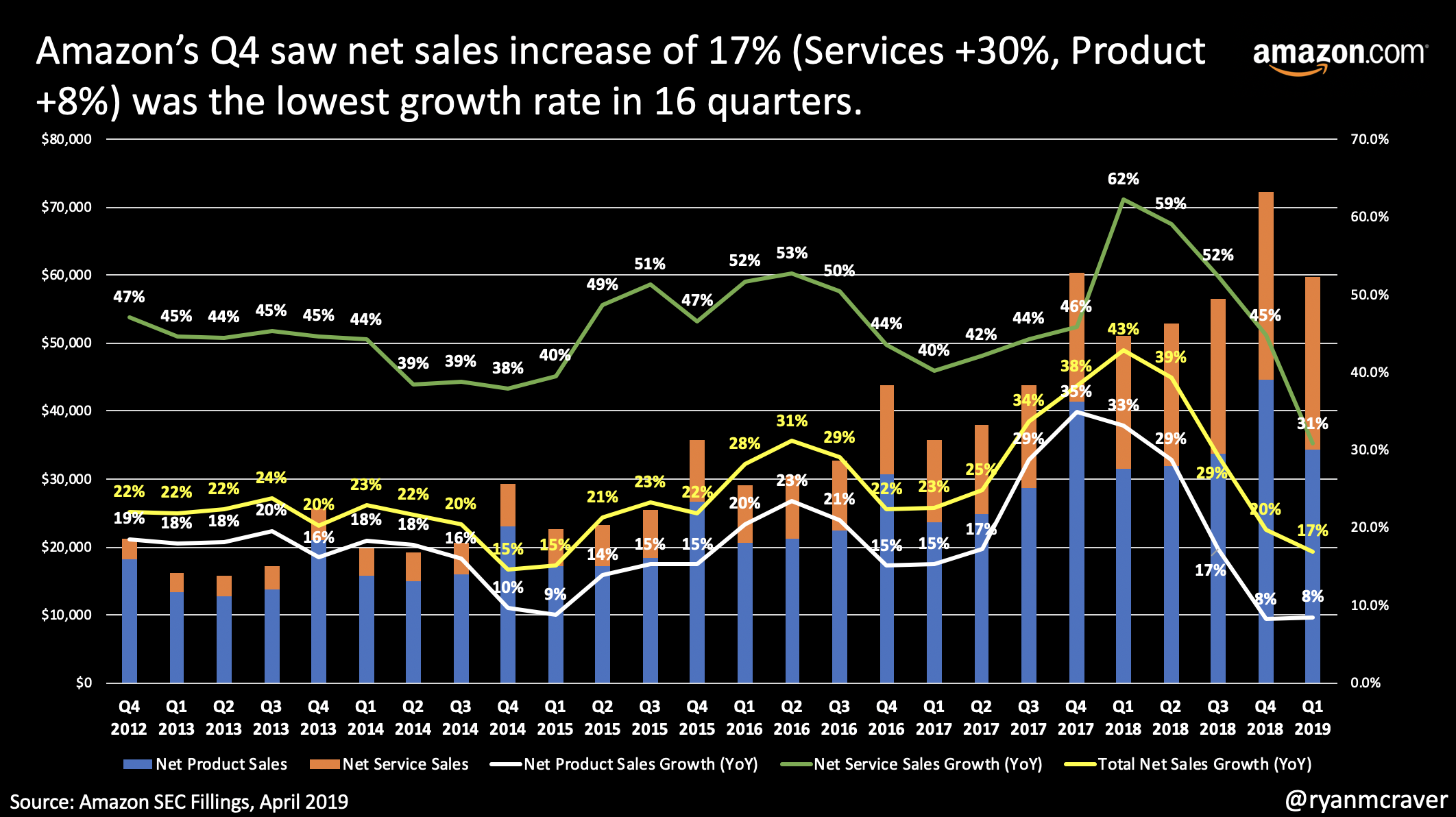

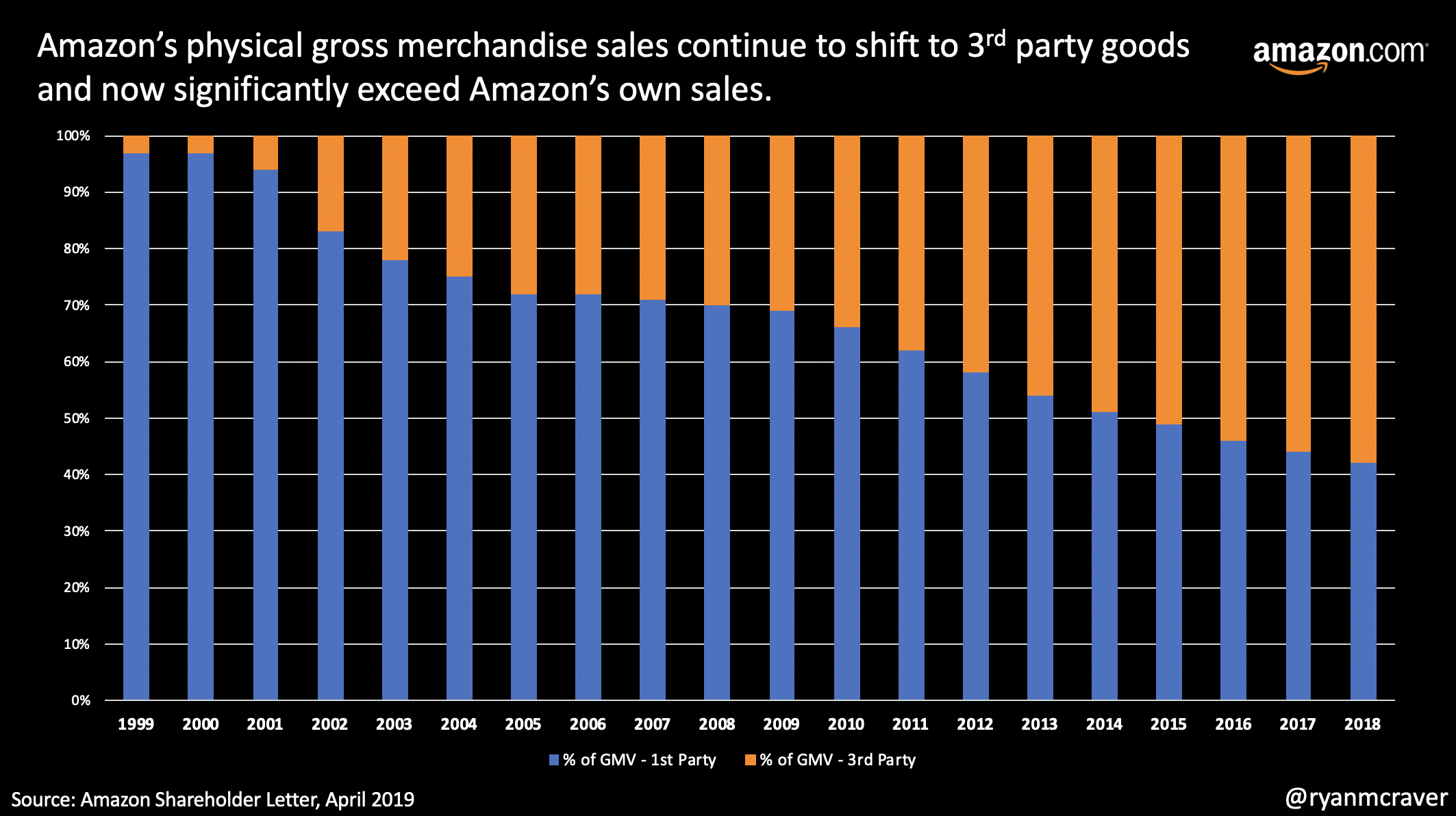

This was a well played and planned earnings release by Amazon. The January earnings release saw the slowest sales growth rate in 16 quarters which continued to slow even further in the recently quarter. The North America business hadn’t posted this small of an increase since 2014 and international since 2015. Whether due to the law of large numbers or the competition stepping up their game, one thing is certain. Amazon is becoming much more profitable as the company becomes less reliant on online owned sales.

So why was Amazon trading up post earnings? In the latest quarter, online accounted for less than 50% of the total revenue in the quarter. Third party revenue (seller services) accounted for 18% with the real growth coming from AWS and subscriptions at 13% (up from 10%) and 7% respectively (up from 5%). Services, services, services = profits, profits, profits. Yes, the p word that no one believes Amazon was capable of just 2 short years ago.

Despite some of the weakest revenue growth figures in years, Wall Street and Main Street still like what they heard and still believe in the Prime, AWS, Services shift.