Astute piece by Buzzfeed on the war happening behind the scenes of Amazon to keep prices ultra-competitive within the Amazon walls:

Behind the scenes on what may appear to be a simple product page on Amazon, a bustle of sellers are all scrambling to win your business. They're fighting over a small yellow box that is emerging as one of the most important battlegrounds in online shopping.

To the average user who lands on a product page it's all pretty straightforward. To the left are photos of the item — a cell phone charger, let's say. To the right, there's the "Add to Cart" button. Pretty simple, right?

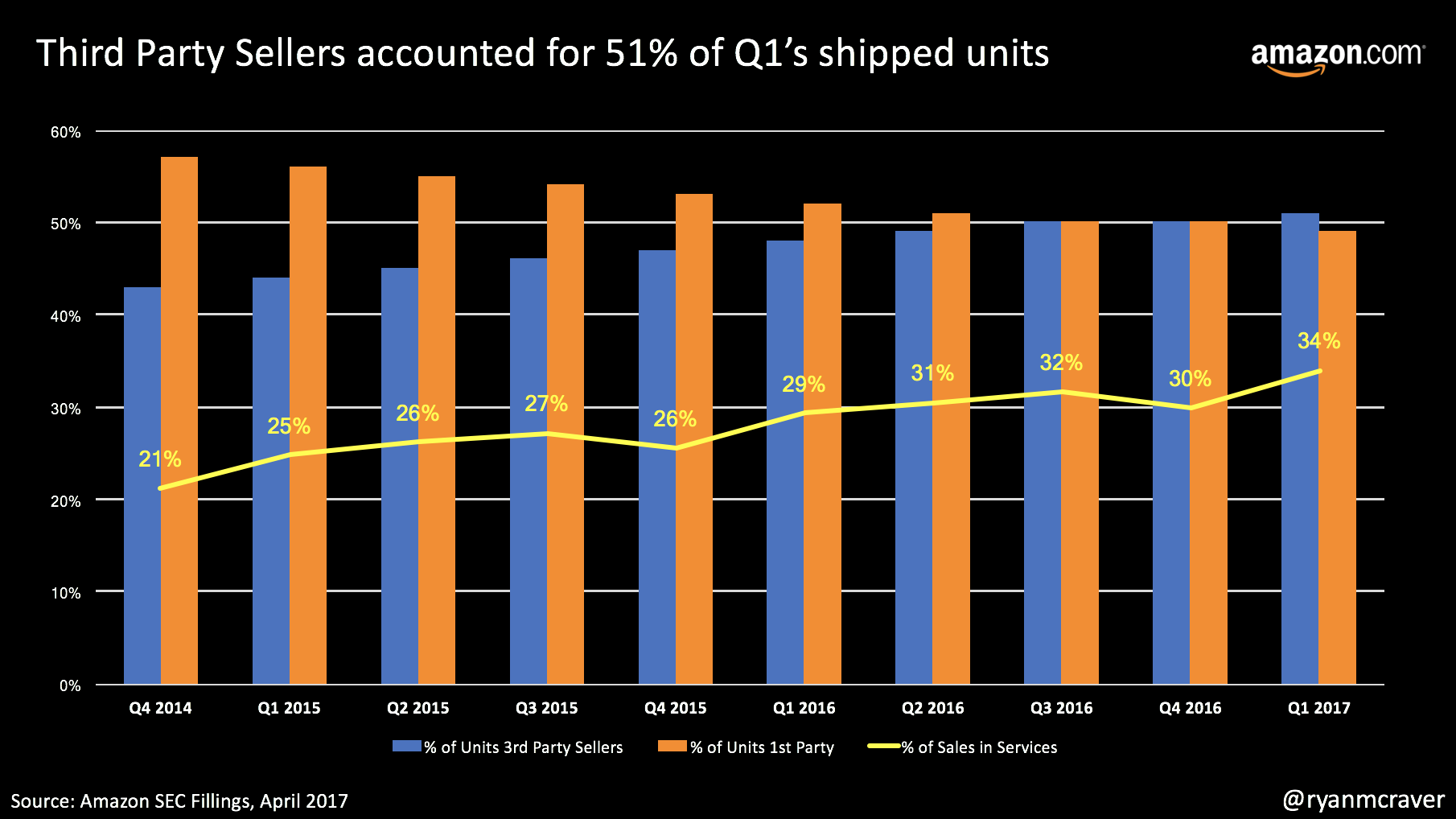

But dozens of sellers may all be offering that same charger, and only one is chosen by Amazon's systems to get the sale when you hit Add to Cart. The others are relegated further down the page, and the vast majority of Amazon users never bother to look at them.

At any point in time, products can have 5-10 sellers competing to sell the exact same product. Although Amazon doesn't explicitly explain which seller earns the "buy box," it is known to be a combination of price and seller reviews. If a seller does not have the buy box, their product is still available for sale but highly unlikely to take place. Therefore, owning the buy box on the main product page is crucial to success for any 3rd party seller.

What about when you are competing with Amazon themselves? How do you expect to beat Amazon on their own site when they have the most reputable account? Almost impossible. Amazon's pricing will continue to match or decrease price until a seller stops.

Note: I will be discussing this and other Amazon related topics at GrowCommerce on July 20 in NYC.