See also: Department Store Earnings: JC Penney, Kohl's, Macy's, Nordstrom

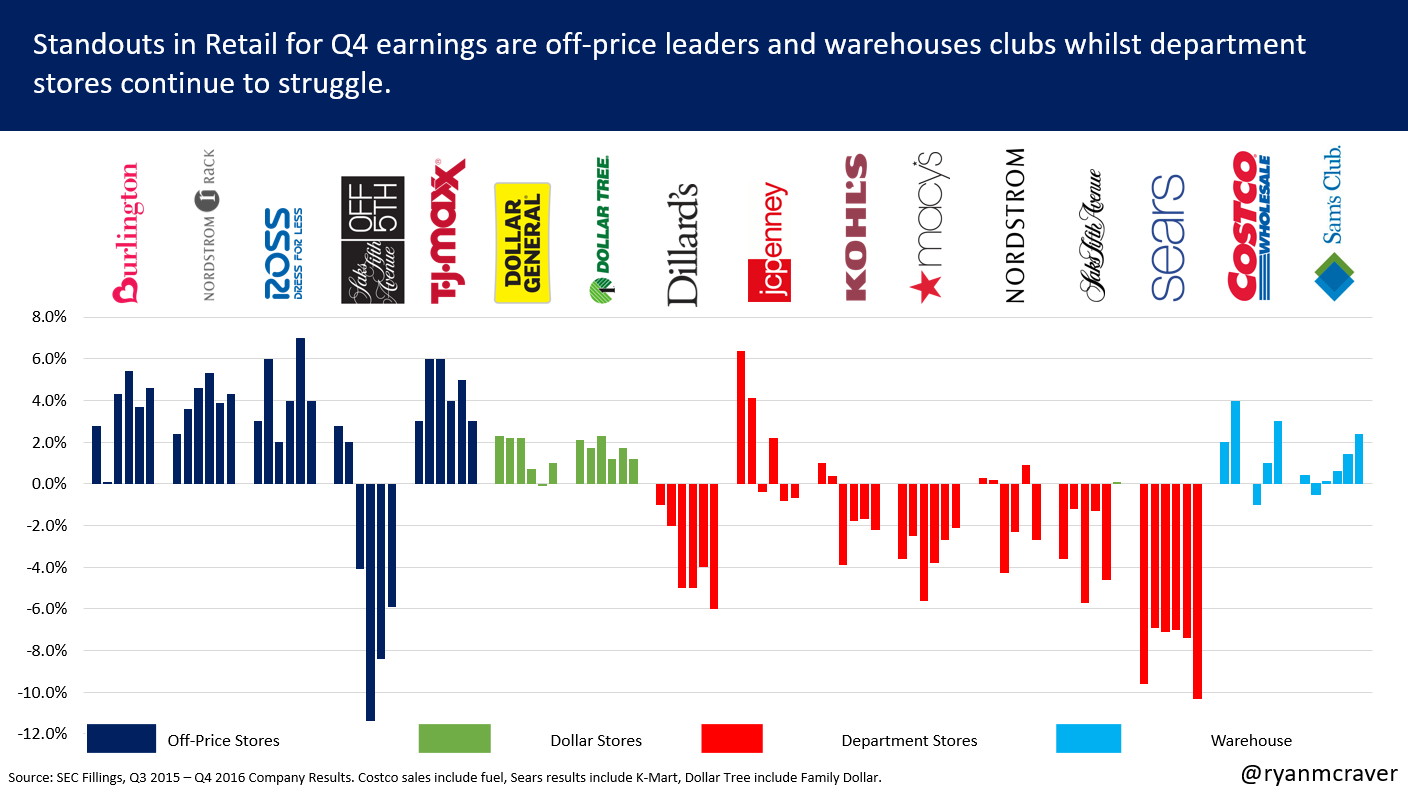

Off Price has been among the shining stars in retail for several quarters and the only shining star within the Apparel retailers for the past couple of quarters. All of that shining was questioned with the first wave of results from Nordstrom Rack, Ross and TJ Maxx. Each of the Off Price Retailers posted the lowest quarterly comp rate in years. Reasons for the drop included weather, merchandise mix and the shift to online. Is the point of Off Price store saturation? Is this the point at which the offline "treasure hunt" of Off Price is no longer preferred over the online "treasure hunt?"

Nordstrom Rack & Nordstrom

- Nordstrom Rack is still positive but came in light posting a 2.3% comp. Last time the business posted a comp below 3% was Q3 2015. Online business was only up 19% vs previous year quarterly growth of 42%.

- Full line store comp was down 6.4% with the total comp (includes online) down 2.8%.

- 100% of stores are still cash flow positive despite the continued weakness in same store sales.

- Management maintained guidance and maintains full year comps of flat.

Ross

- Total comp was up 3%, lowest increase since Q1 2016 which grew 2%.

- Plan to open 90 stores this year.

- Home continues to be strong point.

- Management maintained guidance and sees 2nd quarter comps of 1-2% growth.

TJ Maxx (Marmaxx)

- The headline comp was up 1% but the underlying Marmaxx group comp was flat. This compares to an average comp that increased 4.5% over the last 6 quarters. In fact, all of the TJ Maxx businesses (Marmaxx, HomeGoods, TJX Canada, International) all posted slowing comp growth rates.

- Announced new brand HomeSense with first store opening end of Summer and carrying home furnishings completely different from HomeGoods but at a similar price point. The strategy is similar to their dual Apparel retail model with Marshalls and TJ Maxx.

- Plan to open 250 stores this year and inventories were 7% lighter than last year but last year inventories were quite heavy.

- Management lowered guidance but still believes a 1-2% comp increase will be realized for the full year.